Toronto’s housing market saw a slight cooling in April after months of frenetic activity. March 2021 was an all-time record-breaking month both for the number of homes reported sold and the average sale price in the Greater Toronto Area (GTA). It was unrealistic to believe April 2021 could continue at that pace. However, April was still record breaking, reporting the highest volume of sales for any previous April.

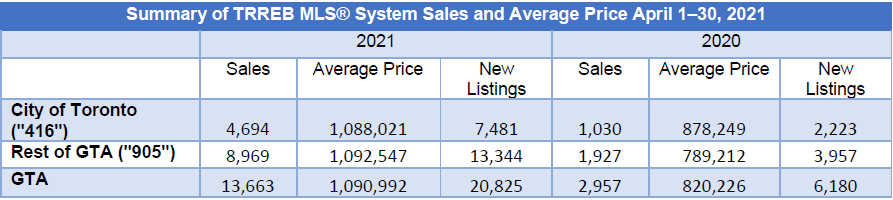

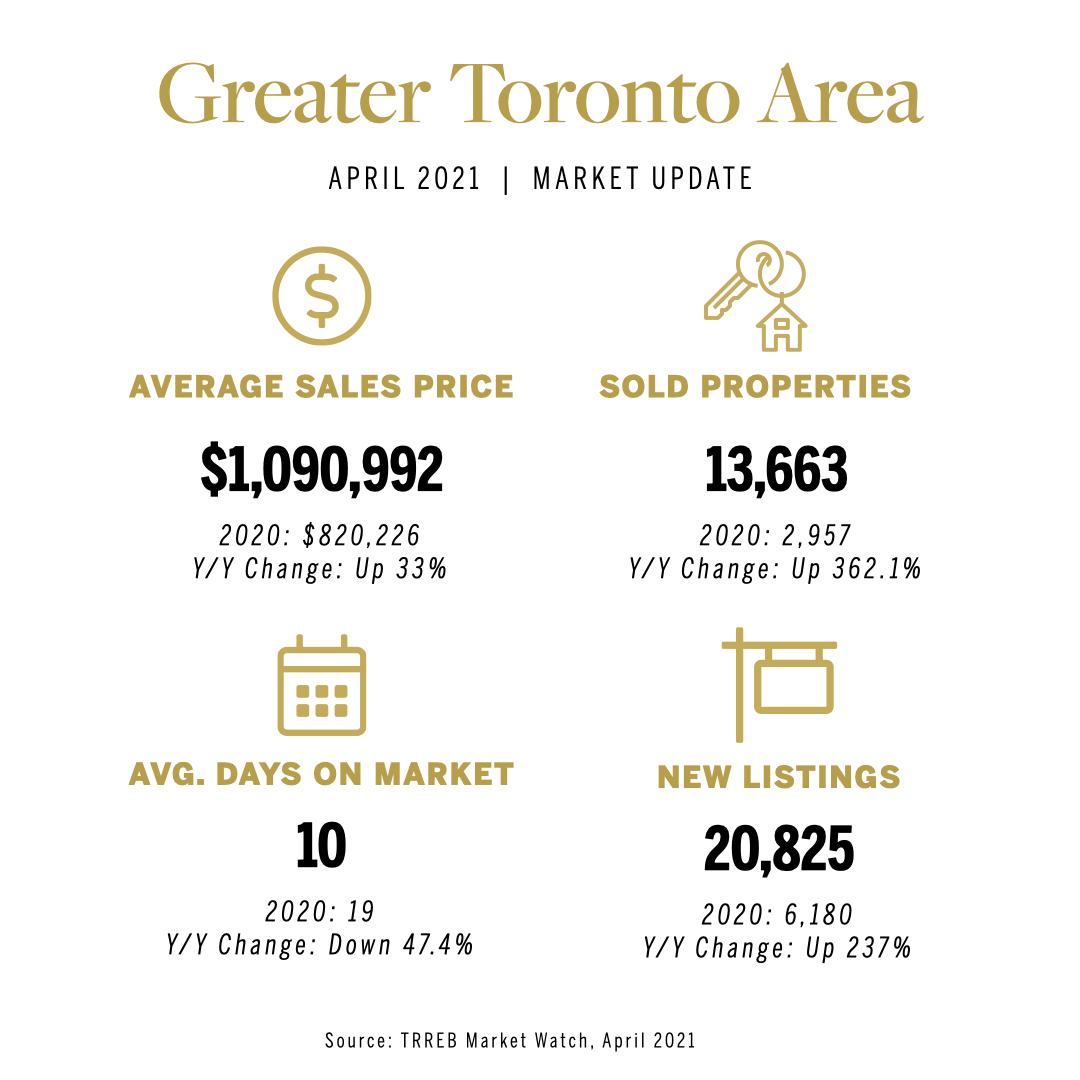

The Toronto Regional Real Estate Board (TRREB) reported 13,663 homes sold, almost 13 percent fewer than the 15,652 that were sold in March. The average selling price of $1,090,992 was up by 33 per cent compared to April 2020 but was basically flat relative to March 2021, when the average selling price in the GTA reached $1,097,565. This contrasted with most years in the past when the average selling price has increased between March and April.

Generally, market reports rely heavily on comparisons to the same month the previous year, however last April was the first full month of the pandemic when buyers and sellers along with realtors were adjusting to the new restrictive measures. As a result, there were very few sales during this period, so it is more realistic to compare April’s market performance to this past March.

New listings also declined 8.4 per cent month over month, although this April’s 20,825 new listings were 18.3 per cent above the 10-year average between 2010 and 2019.

“While sales remained extraordinarily strong last month, many REALTORS® noted a marked slowing in both the number of transactions and the number of new listings. It makes sense that we had a pullback in market activity compared to March. We’ve experienced a torrid pace of home sales since the summer of 2020 while seeing little in the way of population growth. We may be starting to exhaust the pool of potential buyers within the existing GTA population. Over the long term, sustained growth in sales requires sustained growth in population,” said TRREB President Lisa Patel.

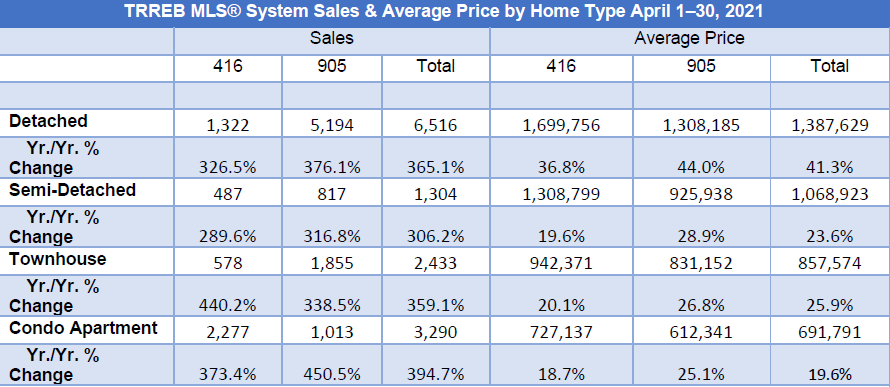

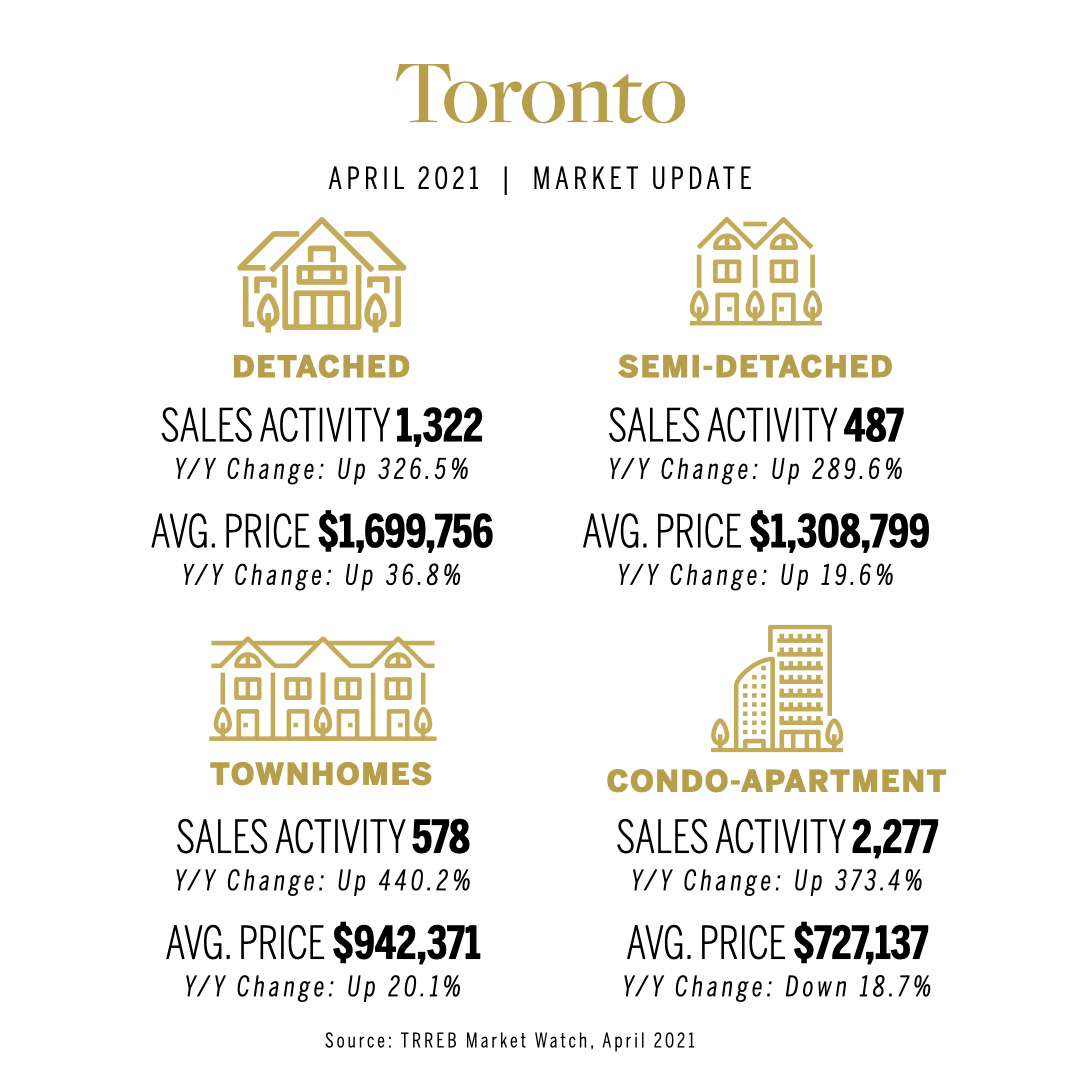

April’s real estate activity continued the trend with detached home sales showing the greatest gains, which accounted for 6,516 of the month’s total sales. The 905-area led the way with 5,194 sales, while the 416-area accounted for 1,322. The average price of a detached home in the GTA reached $1,387,629 in April, up 41.3 per cent year-over-year.

The marginal decline in price was across the board for all housing types, except condominium apartments. Detached, semi- detached, and townhome prices all declined slightly over March 2021. In the City of Toronto, the average price for a detached home was $1,699,756, a 3 per cent drop from March, semi-detached home was $1,288,005, a 1.5 per cent drop, and townhome was $942,371, a 2 per cent drop.

In April, there were 3,290 condominium apartment sales which was a considerable decline from the 3,821 units reported sold in March. This decline of almost 14 per cent, contributed substantially to the overall decline in market sales as compared to March. While sales were not as strong, prices increased both in the City of Toronto and the surrounding 905 regions. The average sale price for City of Toronto condominium apartment came in at $727,137, up from the $707,835 reported in March. In City’s central core where most of the greater Toronto’s condominium apartments are located, the average sale price came in at $781,471, a number that is getting much closer to the average sales prices for condominium apartments of early 2020 before the pandemic.

The price acceleration of ground-level housing over the past year may be shifting some demand back to the condo sector. It is anticipated Canada’s bank regulator will move ahead on June 1st with more restrictive mortgage stress testing rules. This will place further restrictions on buyers’ borrowing power that may push a few home buyers to the sidelines and force others to reconsider the type of housing they purchase or the location of their search.

Although there has been a modest slowing with market activity in April compared to March, selling prices for all major home types remained extremely high. The low borrowing costs during COVID-19 clearly had an impact on the demand for and price of housing ownership. While the pace of price growth could moderate in the coming months, home prices will likely continue the upward trend. Renewed population growth over the next year given the borders are expected to open when the pandemic subsides and Ottawa has increased immigration targets to offset last year’s shortfall coupled with a persistent lack of new inventory will underpin home price appreciation.