The Toronto and suburban area resale housing market started 2021 with incredibly strong results that continues to break records. Home sales across the region were up by more than 50 per cent year-over-year last month according to Toronto Regional Real Estate Board (TRREB) January 2021 report. This strong start to 2021 included sales growth across all major segments including condominium apartments, both in the City of Toronto and surrounding Greater Toronto Area (GTA) regions.

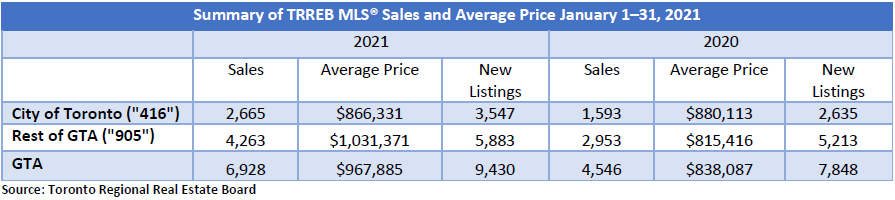

As compared to last January, sales were up by over 52.4 per cent and the average sale price increased by almost 16 per cent. January recorded an unprecedented 6,928 sales compared to only 4,546 last year. The average sale price came in at $967,885 for all properties sold throughout the GTA. It was only $838,000 last year.

Inventory levels remain a problem as we move into February primarily with the ground level freehold properties. At the end of January, there were only 7,396 properties available to buyers, almost 5 per cent less than last year. And many of those listings (44 per cent) were condominium apartments. There is not enough ground level, freehold properties to meet the demand resulting in soaring prices. Most freehold properties are being met with many multiple offers within a day or two of listing.

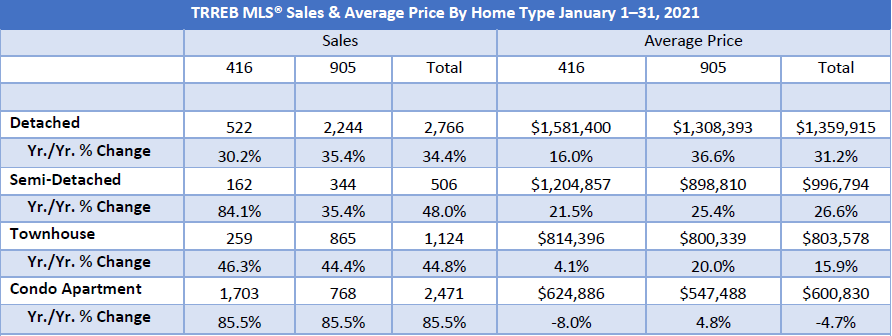

The other news story making headlines is the strength of the market in the suburbs surrounding the City of Toronto. Not only are more sales taking place in the region, but at rapidly rising prices. Outside Toronto, detached house prices soared by almost 36 per cent to about $1.3 million. January recorded a staggering 2,244 detached homes sold in the 905 areas compared to 522 in the City of Toronto. Prices climbed a more modest 16 per cent to an average of nearly $1.6 million inside Toronto’s city borders.

Price growth was driven by other ground level home types too in the City of Toronto. Semi-detached home sales increased by 84.1% with an average price of $1.2 million, an increase of 21.5 per cent year-over -year. Townhome sales were up 46 per cent with an average price of $814,396, an increase of 4.1 per cent over last January.

Higher priced properties throughout the Toronto and the surrounding GTA sold at an unforeseen pace for January. There were 331 properties reported sold in January having price of $2 million or more. This amounts to an incredible 155 percent increase compared to the 130 properties that sold in this price category in 2020, and only 76 in 2019. This is a tremendous result, and it demonstrates the luxury market remains extraordinarily strong throughout the greater Toronto region.

Condominium apartment sales showed positive signs of recovery for a second month in a row after a sluggish year in 2020. There was an 85.5 per cent year-over-year increase in transactions both in the City of Toronto and in the surrounding regions. Although Toronto condo prices declined about eight per cent to $624,886 in January compared to the same month last year, average condo prices in the 905 areas rose five per cent to $547,488.

The hardest hit has been Toronto’s central core. About 70 per cent of all Toronto condominium sales are in the downtown core. Last year the average sale price for condominiums in Toronto’s central districts was $758,000. In January, the identical apartments were selling for $661,000, 13 per cent less. It is not surprising with these steep price reductions buyers are out in full force looking for bargains. While the expectation is that interest in the condo sphere will continue as 2021 rolls on, it is uncertain when price rises will catch up with an increase in demand.

Following a year like no other, the Greater Toronto Area housing market is poised to have a strong record-setting 2021. TRREB expects the average price of a resale home in the Toronto area to climb about 10 per cent this year, surpassing the $1-million mark for the first time. That would bring the average home price across all housing categories for the GTA, including condos, to approximately $1.025 million in 2021.

This forecast is based on strong sales and prices at the start of the year, record low interest rates and the prospect of economic recovery in white-collar employment. Along with immigration expected to increase as the year goes on and these newcomers will add further demand on the housing supply.

“Just looking at the momentum we had based on a strong recovery in many sectors of the economy, especially those with above-average earnings that cater to housing demand, it makes sense the demand for housing generally will remain strong as we move through this year. On top of that you will also see a resurgence in the condominium apartment segment as well,” according to Jason Mercer TRREB Chief Market Analyst.

The board expects total home sales for the GTA to reach a near-record of 105,000 in 2021, with the strong sales growth supported by continued economic recovery, including jobs and record-low borrowing costs. Listings are anticipated to creep up a little bit. With low-rise listings such as single-family homes remaining constrained, TRREB expects total new listings will reach the 160,000 mark in 2021, up from 156,755 last year. Subsequently, market conditions for low-rise homes, including detached houses will remain very tight with sales rising at a faster pace than listings in 2021.

“The pandemic certainly resulted in an unprecedented year for real estate in 2020, but it hasn’t put a damper on the overall demand,” continued Jason Mercer. “Looking ahead, a strengthening economy and renewed GTA population growth following widespread vaccinations will support the continued demand for both ownership and rental housing. But over the long run, the supply of listings will remain an issue, particularly in low-rise segments.”

While mortgage deferrals were initially a concern early in the pandemic, TRREB says Mortgage Professionals Canada does not anticipate any pronounced uptick in mortgage delinquencies that would create concerns in 2021. Most property owners who took advantage of mortgage deferrals did so out of an abundance of caution rather than a financial necessity, and therefore have resumed their regular payments.

Looking ahead, TRREB says the key challenge to the housing market will be a familiar one and that is supply. Policymakers at all levels of government have acknowledged the need for a greater supply and more diverse housing types. Toronto Mayor John Tory says the city has the goal of building 40,000 affordable housing units, including 18,000 supportive homes, 1,000 of which will be modular homes to start to tackle this issue.

Early February data already indicates it will be an even stronger month than January. The resale market is on track to exceed last February’s sales results by at least 50 percent and the average sale price, both in the City of Toronto and the surrounding suburban region will continue to rise as many properties are met with multiple offers. A combination of record low interest rates and the consumers’ overwhelming need to acquire real estate, primarily low rise with outdoor space will continue to drive this robust market for the foreseeable future.