Market Report February 2020

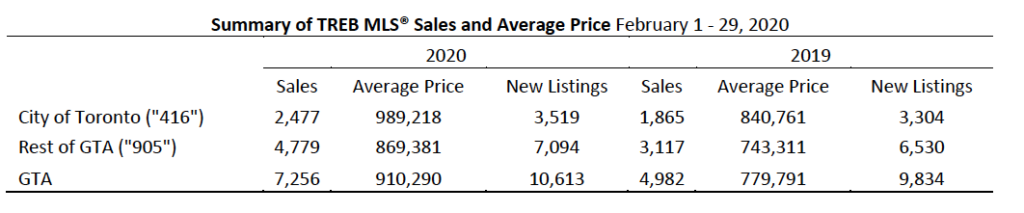

February 2020 in the Greater Toronto Area (GTA) proved to be a very robust time for home sales. The GTA REALTORS® reported 7,256 residential transactions through Toronto Regional Real Estate Board’s (TRREB) MLS® System for the month of February, representing a whopping 45.6 per cent increase compared with the same time last year when the market sat at a policy and stress-test induced 10-year sales low. However, February 2020 sales were still below the 2017 record result.

This is also up 14.8 per cent from January’s sales levels with a 3 per cent increase in average price indicating positive momentum market growth as buyers’ purchasing power certainly seems to be returning in full force.

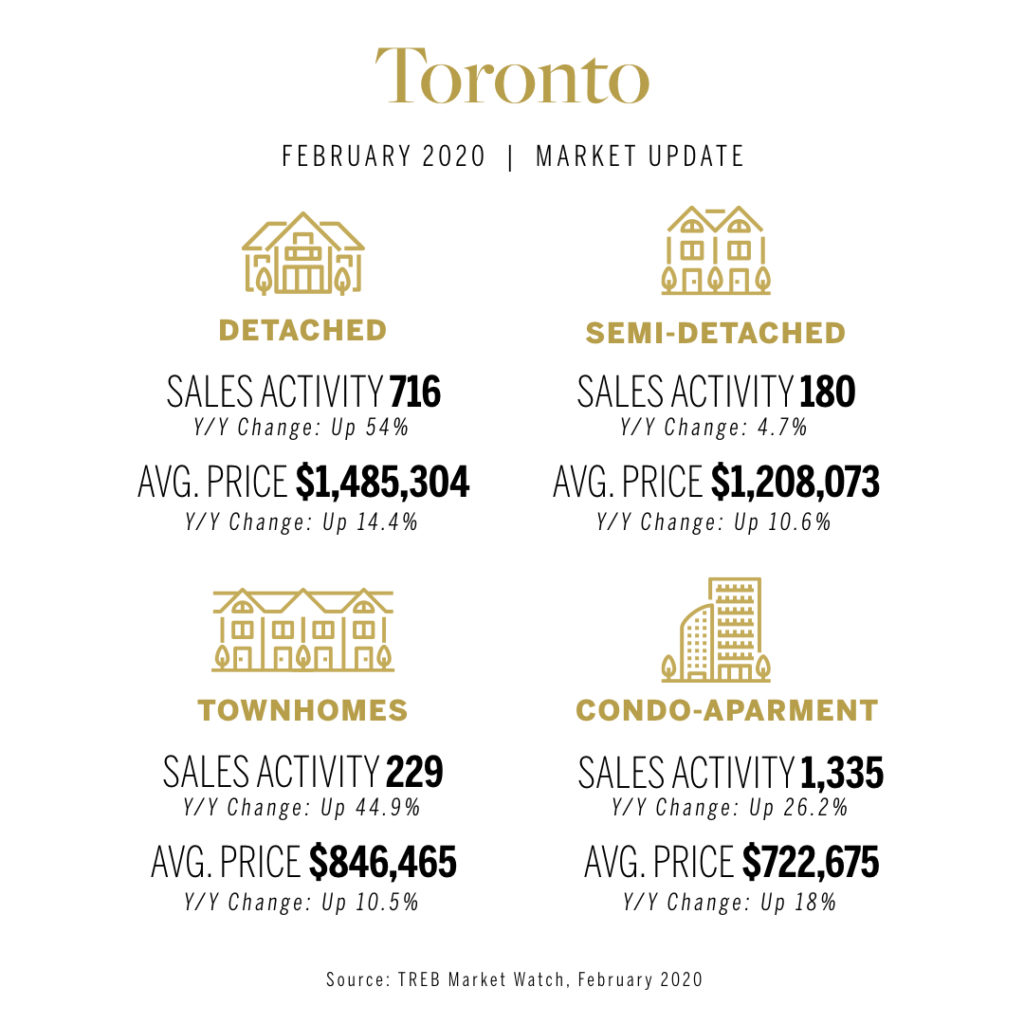

The number of detached houses changing hands was the most significant gain. Sales for houses in the City of Toronto were up by 54 per cent at an average price of $1,485,304, and throughout the total GTA sales of detached homes were up 61 per cent at an average price of $1,113,918. A greater proportion of higher-priced homes in the sales mix and tightened market conditions resulted in accelerated year-over-year price growth in February. The average price for all GTA homes was up by 16.7% over the same time last year to an average price of $910,290, while the MLS Home Price Index Composite Benchmark rose by 10.2%. Most housing types posted almost double-digit price growth with condos rising about 12 per cent over the year.

The second-highest rate of price growth in the GTA during February was the townhouse segment. There were 1,140 transactions which is an increase of 44.9 per cent and an average price of $731,081, up 14.9 per cent over last February. Semi-detached houses saw a similar pace of growth however remain limited with smaller inventory levels. A total of 647 sold, up 43.5 per cent at an average price of $872,821. Meanwhile, condos continued to see double-digit gains with 1,906 units sold, an increase of 24.8 per cent year-over-year with an average price of $666,358 which is up 18.6 per cent.

New listings amounted to 10,613 in February 2020, a 7.9 per cent increase compared to February 2019. This moderate annual growth rate was much smaller than that reported for the number of homes sold, which highlights market conditions tightened considerably over the past year. As a result, the GTA sits in a steep sellers’ market with a sales-to-new-listings ratio of 68 per cent.

“Sales growth well in excess of listings growth is once again the norm. This is because the temporary effects of the 2017 Ontario Fair Housing Plan and the OSFI mortgage stress test have largely worn off. However, while these policies were running their course, the well-publicized housing supply problem in the GTA continued unabated. All levels of government have acknowledged the supply problem, but we need to very quickly move from policy briefs to shovels in the ground,” said TRREB CEO John DiMichele.

In the City of Toronto, the market has been very active in January and February and somewhat reminiscent of the 2017 climate when prices were increasing rapidly, and frantic buyers were making offers well over asking. A lot of buyers seem to have underlying fear if they do not buy now, they most likely will have to spend more in the future.

TRREB’s current average price forecast is for 10 per cent price growth. However, Chief Market Analyst Jason Mercer warns that should current conditions persist long-term, the market could be poised for even greater price growth than what was forecast. The annual pace of sales volume will likely slow as stronger sales came into effect after the first quarter of 2019.

Also, important to note, the federal Finance Department announced changes to its stress test last month for insured mortgages by making it more responsive to market mortgage rates, which have been falling. Some economists have warned this move alone could overstimulate hot markets.

That coupled with The Bank of Canada’s recent significant interest-rate cut could further threaten to overheat the booming housing market, making it easier for home buyers to borrow and further driving up real estate prices.

With the coronavirus quickly spreading around the world and business activity slowing, the central bank slashed its key interest rate Wednesday to 1.25 per cent from 1.75 per cent to keep the economy humming. That followed deep anxiety in public markets where investors sought protection in bonds, sending yields down.

“The dramatic rate cuts and the related bond rally to record low yields will put housing on steroids,” said Douglas Porter, chief economist with Bank of Montreal. “This will probably override consumer caution related to the coronavirus, although there may be a temporary chill in activity due to those concerns.”

It’s too soon to determine if the coronavirus will slow down the pace of sales in the GTA. With the financial market volatility reacting to news of the virus and the potential economic slowdown, it could certainly have an impact on our real estate market. Historically though, remembering back to the spring of 2003 when Toronto was under siege with SARS. The pandemic had little impact on the city’s growing real estate market and zero impact on decreasing housing prices. And with the lower interest rates we could see more people jumping into the market. Time will tell.