The rebound in the Toronto housing market showed signs of easing in June, with sales dipping for the first time in months after the Bank of Canada raised interest rates again, however, the shortage of available homes kept buyers’ competition strong and pushed prices higher.

The Toronto Regional Real Estate Board (TRREB) reported a total of 7,481 sales in the whole Greater Toronto Area (GTA) for the month of June, which is up 16.5% from June 2022, although down slightly from the 9,012 sales seen in May. A drop-off is normal in the typically less active summer months, but home sales most likely were further hampered by the uncertainty surrounding the Bank of Canada’s outlook on inflation and interest rates.

“The demand for ownership housing is stronger than last year, despite higher borrowing costs. Furthermore, a persistent lack of inventory likely sidelined some willing buyers because they couldn’t find a home meeting their needs. Simply put, you can’t buy what is not available,” said Toronto Regional Real Estate Board (TRREB) President Paul Baron.

Most of this year has been characterized by the scarce number of homes available for sale. In June only 15,865 properties came to market which was a 3% decline on an annual basis, making clear that supply is far from keeping up with the jump in demand. At the end of June there were only 14, 107 homes available to buyers (more than 12% fewer than last year). With the significant growth in the GTA’s population, at least 20,000 properties should be available for sale to even begin to reflect a balanced market.

The year-over-year increase in sales coupled with the decrease in new listings mean market conditions were tighter this past June relative to the same period last year. The average selling price for a home in the GTA rose by 3.2% to reach $1,182,120 from last June, but down slightly from the average price of $1,195,929 in May.

Another measure, the home price index (HPI), which excludes the highest valued properties, rose 2.5% to $1,163,200 from May to June on a seasonally adjusted basis, according to the TRREB. That was the fourth consecutive month of price increases.

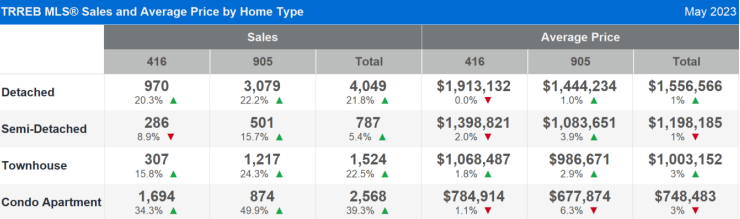

Of the homes that did sell in June, the lion’s share came in the form of detached houses, accounting for 3,377 of the month’s transactions. They were followed by condo apartments (2,122), townhouses (1,233), and semi-detached homes (678). Every housing type saw an increase in sales compared to the same time last year, but condo apartments handily took the lead with a 27.2% jump.

Every housing type saw an increase in sales compared to the same time last year, but condo apartments handily took the lead. Detached home sales jumped 13.3% to 3,377 year-over-year, while semi-detached properties rose 7.4% to 678 in the same period. Townhouses were up 13.1% at 1,233 and condo apartments climbed a whopping 27.2% to 2,122.

Prices of all housing types other than condos were up on a year-over-year basis across both the suburban 905 area code and the much more urban 416.

Although the number of condos sold were up from last June, prices dropped on average by 1.1% from last year. The change was a mere 0.2 % in the City of Toronto — but higher in the 905 areas where it dropped by 1.1%.

In the City of Toronto, the average sale price for detached homes was $1,785,128, an increase of 9.2% compared to last June. Semi-detached homes averaged $1,408,550 which is a significant 21.6% increase year-over-year.

Even with this high cost of housing, the Toronto and surrounding area seem to be remaining resilient as the average days on the market in June were only 14 days. And on average homes were selling at 104% of the list price.

The strength in the resale housing market is due to a combination of significant population growth and a shortage of supply. In June, Canada’s population increased by 84,000 due to immigration and most of those immigrants will relocate to southern Ontario. Last year 227, 235 new immigrants arrived in Ontario.

“GTA municipalities continue to lag in bringing new housing online at a pace sufficient to make up for the current deficit and keep up with record population growth. Leaders at all levels of government, including the new mayor-elect of Toronto, have committed to rectifying the housing supply crisis. We need to see these commitments coming to fruition immediately, or we will continue to fall further behind each month,” stressed TRREB CEO John DiMichele.

Looking forward, the strong demand for housing in Toronto is expected to continue, driven by a resilient economy, a tight labour market, and record population growth – which has kept home sales well above last year’s lows. However, the Bank of Canada’s recent interest rate decisions, and its guidance on inflation and borrowing costs for the remainder of 2023 will help us understand how much sales and prices will recover beyond current levels. Amid these high interest rates, affordability will remain extremely challenging.