The Greater Toronto Area (GTA) housing market continued to make impressive rebounds in May as homebuyers showed no signs of slowing down. Amidst limited listings and high demand, average home prices continued to be pushed back up.

And it was the fourth consecutive month of rising sales. The Toronto Regional Real Estate Board (TRREB) reported 9,012 homes sold in May which is a 20% increase compared to the 7,521 sales achieved in April. This number also marks a 25% increase compared to the 7,226 sales reported in May 2022.

Unfortunately, the supply of homes for sale did not keep up with the demand for buyers wanting to purchase a home. A lot of sellers are still hesitant to list for fear of not being able to find their next home. In May 15,194 new listings came to market. Although up 33% from April’s 11,364, this was down 18.7% compared to the same time last year.

For the second consecutive month of similar conditions, sales represented more than 70% of the new listings. A measurement this high represents a very tight market supporting strong price growth. The last time the market was this tight was at the peak of the pandemic’s real estate boom in January of last year. Entering June there were only 11,868 properties available to buyers – a volume that is about 50% below the 10-year average for May.

One measure of how tight the market is months of inventory, or how long it would take the market to sell its active listings at the current rate of sales. This fell to only 1.3 months at the end of May compared to 2.76 months in January, which points to a substantial tightening over the first five months of the year.

“The demand for ownership housing has picked up markedly in recent months. Many homebuyers have recalibrated their housing needs in the face of higher borrowing costs and are moving back into the market. In addition, strong rent growth and record population growth on the back of immigration has also supported increased home sales. The supply of listings hasn’t kept up with sales, so we have seen upward pressure on selling prices during the spring,” said TRREB Chief Market Analyst Jason Mercer.

With the supply of listings struggling to keep up with demand, this scenario is having a major impact on the average sale prices. According to the Home Price Index (HPI), which excludes the highest-valued properties, the composite benchmark for May dipped by 6.9% year-over-year. Nevertheless, it increased by 3.2% on a seasonally adjusted monthly basis compared to April 2023. Meanwhile, the average selling price of all homes was $1,196,101, which is only a slight decline of 1.2% compared to May 2022. On a seasonally adjusted monthly basis, the average selling price realized a reasonable gain of 3.7% over April 2023. In Toronto, the benchmark price is already up 6.8% since February.

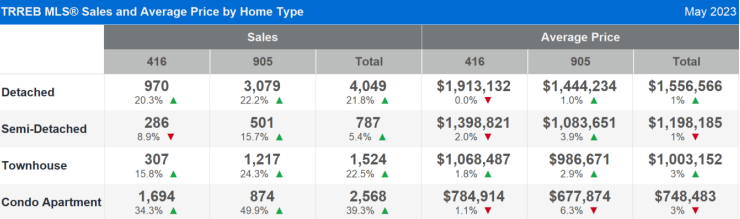

Unlike in April, the City of Toronto held a higher average selling price in May than the rest of the GTA coming in at $1,197,021. This was led by the more expensive detached home sector, which saw their Toronto sales increase by more than 200 compared to April. The average price of detached properties in Toronto came in at almost $2M with all sales taking place in 13 days and 105% of the listing price.

Semi-detached properties sold for an average price of $1, 398,821 in the City of Toronto which was down just 2% year-over-year. Townhomes were up 1.8% to an average price of $1,068,487, and condominiums sold for an average price of $784,914, down 1.1% from May 2022.

As demand keeps climbing, and supply clearly isn’t keeping up, TRREB President Paul Baron underscored the necessity of governments taking action against the growing unaffordability of housing.

“Despite the fact that we have seen positive policy direction over the last couple of years, governments have been failing on the housing supply front for some time,” Baron said. “Recent polling from Ipsos found that City of Toronto residents gave Council a failing grade on housing affordability and pointed to lack of supply as the major issue. This issue is not unique to Toronto. It persists throughout the Greater Golden Horseshoe. If we don’t quickly see housing supply catch up to population growth, the economic development of our region will be hampered as people and businesses look elsewhere to live and invest.”

And TRREB CEO John DiMichele warned against municipalities looking to generate revenue through increased property taxes which is a hot topic in Toronto’s upcoming mayoral election.

“The high cost of housing, brought about by short supply and high borrowing costs, is part of the broader increases in the cost of living. Municipalities, including the City of Toronto, need to be mindful of this when considering their revenue generation options. TRREB believes households will have little patience for higher taxes, including unreasonable property tax hikes and increases to prohibitive upfront land transfer taxes,” said DiMichele.

This age-old supply-demand predicament presents an opportunity for sellers who may have been biding their time until now. With the price appreciation in recent months, the gap is closing on the bottoming out of the market in late 2022 and early 2023. Overall, we are not quite back to the peak prices of early 2022, however, in many neighbourhoods it is an opportune time to sell.

The most recent Bank of Canada rate increase came as a surprise to many and we will have to see how it affects buyer behavior’s. June’s results will be somewhat telling as to the direction of the Toronto resale market for the second half of 2023.