June home sales in the Greater Toronto Area (GTA) were up compared to last year but remained below the March 2021 peak and were lower than the number of transactions reported for May 2021, consistent with the regular seasonal trend. The average selling price in June increased by double digits compared to last year as well, but the annual rate of increase moderated compared to the previous three months.

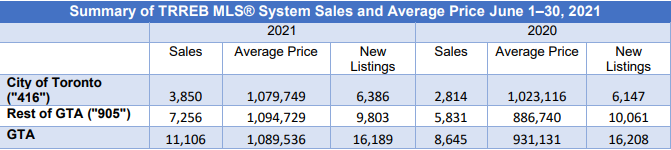

According to the Toronto Regional Real Estate Board (TRREB), there were 11,106 sales for the GTA recorded in June, a 28.5 per cent year-over-year increase, though this is down roughly 7 per cent from May’s 11,951 transactions. In the City of Toronto 3,850 properties changed hands. In both areas, these numbers were substantially lower than the record peak achieved in March. To put things in perspective though, sales activity in June was only outpaced by June sales achieved in June 2016. By historical measures it was still one of the strongest June’s on record.

“We have seen market activity transition from a record pace to a robust pace over the last three months. While this could provide some relief for home buyers in the near term, a resumption of population growth based on immigration is only months away. While the primary focus of policymakers has been artificially curbing demand, the only long-term solution to affordability is increasing supply to accommodate perpetual housing needs in a growing region,” said TRREB President Kevin Crigger.

In June, the average sale price for all property types sold in the GTA was $1,089,536 which is 17 per cent higher than last year at $931,131. The average sale price for the City of Toronto was a little lower at $1,079,749 due to the city’s numbers are heavily weighted to condominium apartment sales.

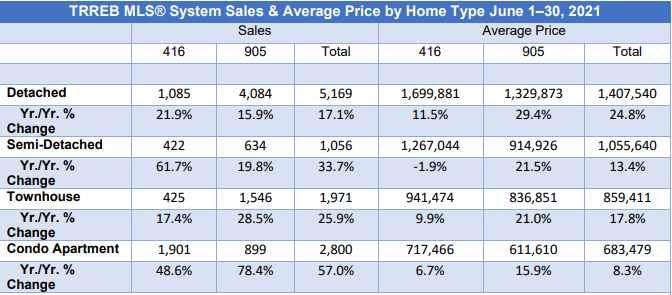

Prices of detached and semi-detached property in the City remained extraordinarily strong at $1,700,000 and $1,267,000, respectively. Detached properties increased by 11.5 per cent year-over-year, while semi-detached sale prices declined by almost 2 per cent which was due more to lack of supply.

The high end of the market continued to perform very well through June. This year 699 properties having a sale price of $2 million or more were reported sold. This is an increase of almost 92 per cent over last year’s 365 properties sold in this price range.

Detached houses in the 905 areas around the City of Toronto continued to lead price growth, rising a whopping 29.4 per cent year-over-year to an average price of $1,329,873. Followed by semi-detached property prices which increased by 21.5 per cent to $915,000. These price gains reflect buyers are continuing to move to less expensive, ground-level homes in areas outside the city with the need for more space and security during these pandemic times.

While price growth in June continued to be driven by the low-rise segments of the market, it is interesting to note is that growth was the strongest in the condo segment, both in Toronto and in the surrounding suburbs. Condos sold for 8.3 per cent more in June compared to the same month last year, with the 905 communities seeing the greatest gain of 15.9 per cent to an average selling price of $611,610. In comparison, Toronto saw a 6.7 per cent price growth, to an average of $717, 466.

It appears buyers are returning to high rise living. In June 2,800 condominium apartments were sold in the GTA which is a 57 per cent increase over last June. The bulk of these sales were in the City of Toronto with 1,901 units sold. The pace of condo sales in central Toronto was very brisk with the average days on market only 15 days and the average selling price 102 per cent of the list price.

In all major market segments, year-over-year growth in sales well outpaced growth in new listings over the same period, pointing to the continuation of tight market conditions characterized by competition between buyers and strong price growth. In June only 16,189 new listings came on the market, which is about the same number as last year. With the extraordinary absorption in sales that have taken place in 2021, there are only 11,297 properties at the start of July available to buyers, approximately 20 per cent fewer than were available the same time last year.

As home sales in the GTA continue to outpace new listings, TRREB has revised its 2021 sales forecast and average listing price, with the expectation that they will both rise even higher — to record levels, forecasting 2021 to be the biggest year in market history. The real estate board had originally forecast home prices to hit an average $1,025,000 million by year’s end and that number has now been adjusted up to $1,070,000 million. Although the board says sales have peaked for 2021 with the first-quarter activity higher than expected, after March home sales at more than 15,000 represented an all-time monthly record. Considering the record Q1-2021 sales result, TRREB has revised its 2021 sales forecast and anticipates the year will end with 115,000 transactions — 10,000 more than it originally forecast.

“Home sales soared at the start of the year, with a huge sales record in the first quarter. However, the record pace of sales has run its course as pent-up demand has increasingly been satisfied in the absence of normal population growth. With this said, a persistent lack of inventory across most segments of the market will keep competition between buyers strong, resulting in an average selling price well above $1 million through the end of 2021,” said TRREB Chief Market Analyst Jason Mercer.

There is a lot of chatter going on about the market cooling. Despite a decline in sales since the market’s March peak, the reality is that Toronto’s real estate market is still extraordinarily strong by many measures. Prices continue to climb month over month in the GTA even though the number of transactions has been on the decline. The reality is we are comparing the market to what a market it was two and three months ago. Toronto’s market is still very quick and competitive, just not as much so as it was only a few months ago. We are still seeing bidding wars however not as frenzied nor as many bidders.

A decline in sales often characterizes the start of a housing bubble and then the next step is an increase in inventory. In Toronto we are not seeing this where the supply of single-family home remains very tight. With the market peaking early this year, it is anticipated current market trends will continue through the summer. We seem to be experiencing more seasonal cycles with consumers returning to somewhat normal summer activities after the province has been in lockdown for many months. Most likely September sales will ramp up quickly however it all depends on how much inventory comes onto the market and how many buyers get back into the market.