The Toronto region’s frenzied pace of home sales that appeared at the start of the year continued to cool for the second month in a row in May, as many exhausted buyers seem to take a break with losing out on too many multiple offers. However, despite this slight ebb in sales over the last two months, market conditions remained tight enough to push the average selling price to an all-time record of $1,108,453 in May.

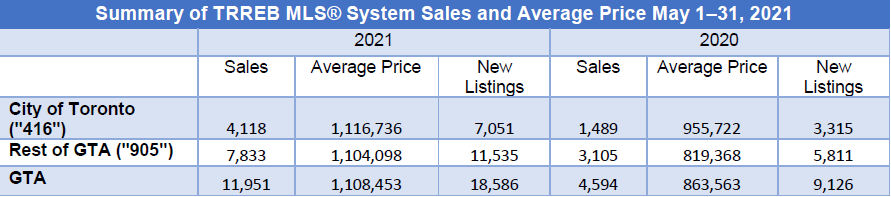

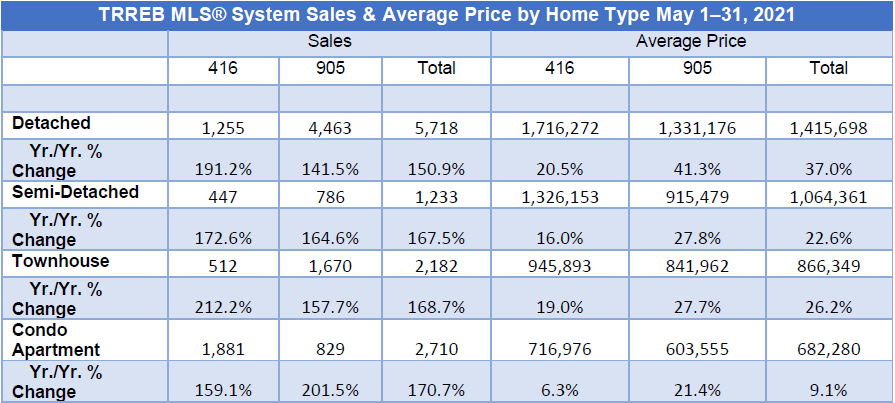

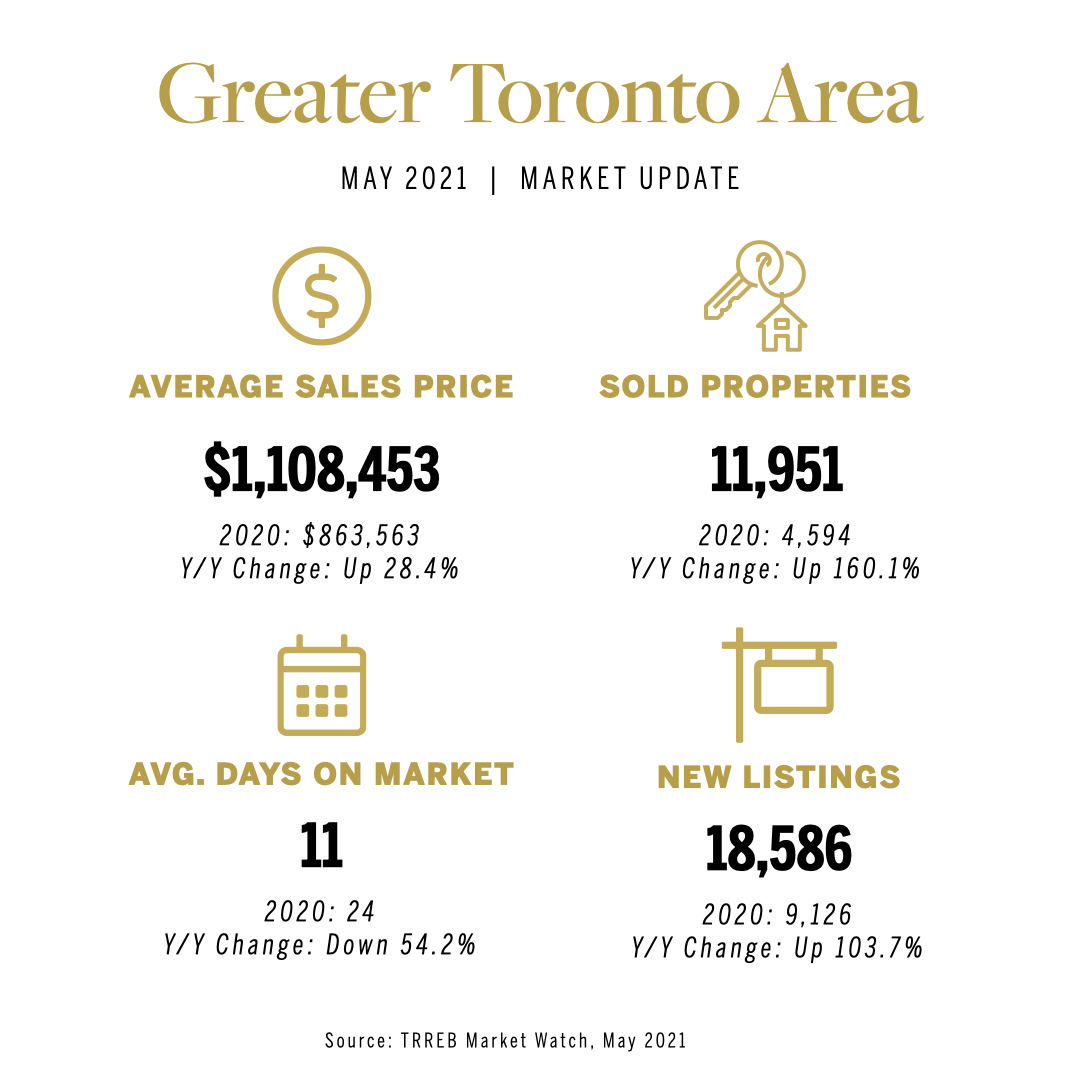

The Toronto Regional Real Estate Board (TRREB) reported 11,951 sales in May 2021 for the Greater Toronto Area (GTA) – more than double the result from May 2020, the second full month of the pandemic. May 2021 sales were below the May 2016 record of 12,789 but remained well above the ten-year average for May of 10,336 homes sold. Often, May is the strongest sales month in any given year. However, 2021 results bucked this trend with May sales 23.6 per cent below the record 15,646 transactions reported in March and 12.5 per cent lower than April results.

“There has been strong demand for ownership housing in all parts of the GTA for both ground-oriented home types and condominium apartments. This was fueled by confidence in economic recovery and low borrowing costs. However, in the absence of a normal pace of population growth, we saw a pullback in sales over the past two months relative to the March peak,” said TRREB President Lisa Patel.

What does this mean for prospective home buyers? Really, nothing much.

Sales might be falling, but so too are new listings, meaning that, as TRREB Chief Market Analyst Jason Mercer explains, “people actively looking to purchase a home continue to face a lot of competition from other buyers, which results in very strong upward pressure on selling prices.”

In May, the Toronto region had 18,586 new listings, compared to just 9,126 last year, when sellers were hesitant to show their homes in the initial phase of the pandemic. While May’s listings were up over 100 per cent year-over-year, they were down 18.1 per cent from March’s peak.

COVID-19 has proved to be no match for Toronto’s housing market, which has continued to see soaring prices and bidding wars even as lockdowns and stay-at-home orders were implemented.

Across the GTA, the average selling price reached a record high of $1,108,453 in May, an increase of 28.4 per cent over last year’s $863,563, when much of the economy was still shuttered. The home price index, which adjusts pricing volatility, reached $1,045,800 an increase of close to 19 per cent year-over-year. On a seasonally adjusted basis, the average price in the GTA from April to May increased by 1.1 per cent to $1,061,987 which is a slower pace of price increase than earlier this year.

The price of detached houses in the 905-area surrounding Toronto rose 41.3 per cent year-over-year in May to an average of $1,331,176. In the City of Toronto, where the price increase has been less dramatic, prices were up 20.5 per cent year-over-year with detached houses selling for an average of $1,716,272.

The 905-area also saw the most robust sales activity for semi-detached homes and townhouses. Prices were up 27.8 per cent to $915,479 for semi-detached and 27.7 per cent to $841,962 for townhomes year-over-year in May. This continues to suggest buyers are still looking for homes with more space.

Condo prices, which had been relatively flat in the City of Toronto compared to detached homes, rose 6.3 per cent in May to an average of $716,976. The surrounding 905-area condo market continued to lead this segment with a 21.4 per cent year-over-year increase to an average of $603,555.

On June 1st, new changes to the mortgage stress test took effect. Now the minimum qualifying rate for uninsured residential mortgages, those with a down payment of 20 per cent or more, rose to either the contracted rate plus two percentage points or 5.25 per cent, whichever is higher. Economists do not expect the tougher mortgage stress test to trigger a downturn like the one that occurred when Ottawa introduced the initial rules back in 2016 and 2017. But there is a sense with some buyers who are now hesitant and waiting to see if this will reduce the pool of qualified buyers with it being slightly harder to qualify for a mortgage and may help cool down prices.

The board’s CEO John DiMichele warns that the current housing supply shortage will continue to impact affordability until something is done to remedy the problem.

“Policymakers at all levels have acknowledged that supply is an issue. It is important to understand that dealing with this issue will be important not only for ensuring long-term housing affordability, but also the economic competitiveness of the Greater Golden Horseshoe,” said DiMichele.

In summary, TRREB predicts home prices will continue to rise through 2021 with listings down month over month, including for condos in the city of Toronto. This moderation in activity over the past two months should not be mistaken as a sign of rapid cooling demand, as activity is still far above pre-pandemic levels. Bidding wars may be involving fewer participants, but they were still rampant in May keeping sellers in an extraordinarily strong bargaining position. Conditions for strong price gains remain firmly in place for the foreseeable future.