With 2025 now behind us, the Greater Toronto Area (GTA) housing market reveals a year defined by continued recalibration rather than recovery, a process that has been underway since the post-pandemic peak of early 2022. December’s results brought that story into sharp focus, confirming many of the themes that shaped the year. We saw restrained sales activity, elevated inventory levels, softening prices, and a buyer mindset tempered by economic uncertainty and affordability challenges.

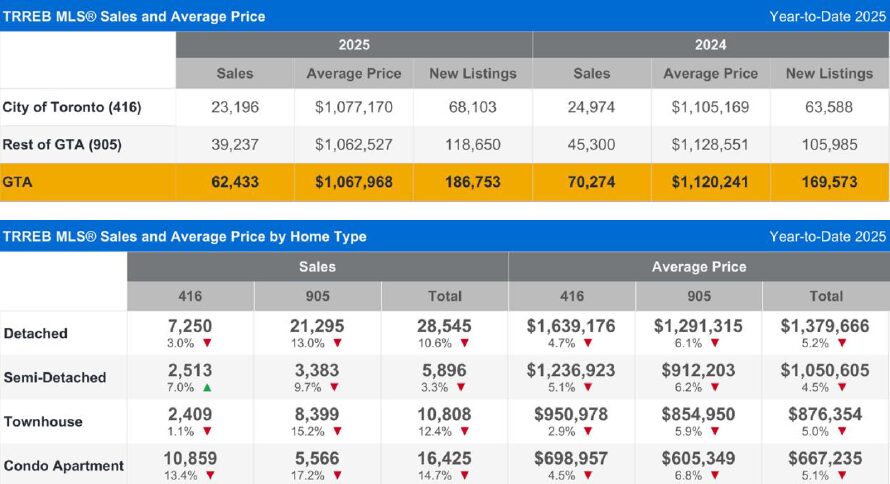

Across the GTA, the Toronto Regional Real Estate Board (TRREB) reported 3,697 homes traded hands in December, reflecting a year-over-year decline of just under nine percent. While some seasonal slowing is typical at year-end, the broader context is more telling. Total annual sales for 2025 reached approximately 62,400 transactions, representing a double-digit decline from 2024 and one of the weakest resale years in decades when viewed against the region’s significant population growth. Inventory, however, remained plentiful. More than 17,000 active listings were available at year-end, affording buyers greater choice and negotiating leverage, with conditions generally favouring buyers in many segments.

“The GTA housing market became more affordable in 2025 as selling prices and mortgage rates trended lower. Improved affordability has set the market up for recovery. Once households are convinced that the economy and labour market are on a solid footing, sales will increase as pent-up demand is satisfied,” said Toronto Regional Real Estate Board (TRREB) President Daniel Steinfeld.

Pricing trends continued to ease. The average GTA sale price in December was just over $1,006,000, down approximately five percent from the same time last year. For the full year, the average selling price settled near $1.07 million, a decline of close to five percent compared to 2024 and roughly 25 percent below the market peak reached in early 2022. Benchmark prices followed a similar trajectory, reinforcing that price adjustments were broad-based rather than isolated to any single housing type.

Within the City of Toronto, market dynamics largely mirrored those of the broader region, though with subtle differences. December sales in the city showed modest year-over-year improvement, suggesting selective resilience where pricing aligned closely with buyer expectations. That said, prices continued to trend lower. The average Toronto sale price declined to just under $987,000, while benchmark prices were down more than four percent annually. Condominium apartments remained the most challenged segment, particularly downtown, as investor demand, once a major driver of absorption, remained largely absent.

Looking back on 2025 as a whole, it is clear that early-year hopes for a rebound were repeatedly deferred. Economic and geopolitical uncertainty weighed heavily on consumer confidence, while affordability remained the central constraint despite several Bank of Canada rate cuts. Although borrowing costs eased modestly, fixed mortgage rates remained influenced by bond yields, limiting the practical impact for many households. As a result, buyers remained cautious, discretionary moves were delayed, and overall activity stayed muted.

“Reaffirmed trade relationships and large-scale domestic economic development projects will be key for improved home sales moving forward. GTA households must be confident in their employment situation before committing to long-term monthly mortgage payments, even in this more affordable market,” said TRREB Chief Information Officer Jason Mercer.

At the same time, the elevated level of listings throughout the year allowed prices to adjust downward, slowly improving affordability relative to recent highs. From a longer-term perspective, this reset may ultimately prove constructive. By reducing excesses built up during the pandemic years and restoring balance between supply and demand, the market is gradually moving toward a more sustainable footing.

“We urge governments at all levels to take action now to provide tax relief for consumers and help ease the rising cost of living. Families and individuals need financial breathing room so they can afford a home or apartment and meet their basic needs. Fair and responsible tax policies can put more money back into people’s pockets, restore consumer confidence, and rebuild trust in the economy. These actions are essential to support stable households and create an economy that works for everyone,” said TRREB CEO John DiMichele.

As we look ahead to 2026, cautious optimism is appropriate, though expectations should remain measured. Most forecasts point to a modest increase in sales activity, driven by pent-up demand from households that have remained on the sidelines for several years. However, this improvement in volume is likely to come alongside further price softening, with average values expected to decline modestly before stabilizing. Condominium apartments may continue to experience additional pressure given the elevated supply and lack of investor participation.

For buyers, the coming year is shaping up to offer continued opportunity, especially for those focused on quality, long-term ownership, and lifestyle rather than short-term appreciation. For sellers, success will depend on a strategy targeted at accurate pricing, thoughtful presentation, and patience will be essential in a competitive environment where buyers remain discerning.

In many respects, the market entering 2026 resembles a pre-pandemic landscape. One that is measured, fundamentals-driven, and far less speculative. While challenges persist, this shift lays the groundwork for a healthier and more resilient housing market across the GTA in the years ahead.