Embrace the arrival of the new year! It’s that time again to reflect on the past and gaze into the future. Instead of solely peering ahead, let’s take a moment to rewind and assess the journey of 2023. This retrospective glimpse sets the stage for what lies ahead in 2024.

In retrospect, 2023 unfolded with a unique narrative, marked notably by a strikingly low sales volume. Climbing interest rates leading to high mortgage costs impacted affordability in the Greater Toronto Area (GTA) throughout 2023, keeping many buyers at bay. Just 65,982 homes were sold in the GTA last year, according to the Toronto Regional Real Estate Board (TRREB). This is the lowest annual level since 2000 when 58,343 properties were sold. In comparison, 74,552 homes were sold during the 2008 financial crisis, and 95,151 were sold throughout the first year of the pandemic. Meanwhile, the real estate boom of 2021 — spurred in part by historically low-interest rates resulted in a record-setting 121,712 home sales in the GTA.

Despite this, the average sale for the year reached $1,126,000, the second highest on record. Active listings concluded December at 10,401, ranking as the third highest in the past decade—a quick snapshot of the market.

Zooming in, a closer examination reveals various statistics and trends that paint a more detailed picture. As the Bank of Canada increased its rate, sales began to decline. In early 2023, the Bank did not implement any increases. As a result, spring sales started to increase and in May 8,962 sales were recorded, the highest for any month in 2023. In June and July, the Bank took its policy rate from 4.5 to 5.0, creating a summer lull that lasted through the fall months. What made it worse was the bank continued to hint more rate increases were possible. In June sales dropped to 7,432 and 5,224 in July. Further declines were reported through the remainder of the year with 3,444 reported in December. The cost of borrowing made market accessibility almost impossible for a lot of buyers. Five-year fixed mortgage interest rates were more than 6 %. In January of 2020, just before the pandemic, a five-year fixed rate was trending at approximately 2.89 to 3.09%. As mortgage interest rates continued to increase, the correlation to declining sales volumes was direct and immediate. In July 2022, the policy rate was 2.5% and by July 2023 it had doubled to 5% where it currently remains.

“High borrowing costs coupled with unrealistic federal mortgage qualification standards resulted in an unaffordable home ownership market for many households in 2023. With that said, relief seems to be on the horizon. Borrowing costs are expected to trend lower in 2024. Lower mortgage rates coupled with a relatively resilient economy should see a rebound in home sales this year,” said new Toronto Regional Real Estate Board (TRREB) President Jennifer Pearce.

Perhaps the most remarkable trend of 2023 was the market’s resilience to fluctuating interest rates, showcasing notable price stability. Year over year, the average price witnessed a 3.2% increase, and from November to December, a 0.3% month-over-month uptick. Over the past three years, 28 out of 36 months reported an average price within the $1.050 million to $1.15 million range, with the notable exception being the peak in Q1/Q2 2022. This stability, amidst changing interest rates, is truly noteworthy.

This price stability is somewhat explained by the number of homeowners who acquired properties during the pandemic as most of these mortgage renewals are not slated until late 2024 and beyond, alleviating any immediate economic pressure on homeowners. As a result, there was no surge in supply due to mortgage renewals. In addition to the muted influence of mortgage renewals, a notable factor contributing to the market dynamics is the escalating demand fueled by significant population growth. The pressing need for housing has intensified, creating an upward trend in demand that continues to shape the real estate landscape.

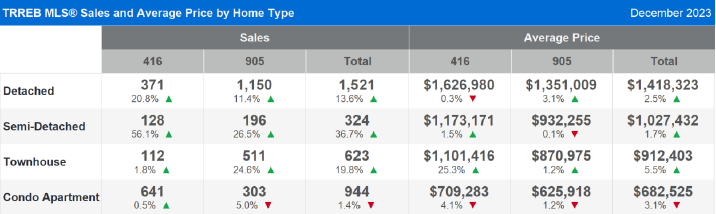

The resilience of average sale prices for freehold homes remains a notable highlight in the real estate landscape. Even in December, traditionally the slowest resale month of the year, detached properties in the City of Toronto came in at an average price of $1,629,980. This figure aligns closely with prices recorded in December 2022. However, reflecting the deceleration in the resale market, these homes sold for 97% of their asking price, spending an average of 31 days on the market. In contrast, the same period last year saw detached properties selling close to 100% of the list price and spending approximately 27 days on the market.

Similarly, the semi-detached home segment maintained its robust pricing, fetching an average of $1,173,171 in December—a 1.5% increase from the previous year. These properties sold for 98% of their asking price, a marginal decrease from 100% achieved last December.

The average price for condominium apartments continued to decline which comes as no surprise given these are the entry point for most buyers-especially first-time buyers. This group is most affected by the high borrowing costs along with investor buyers. In December the average sale price declined by more than 4% to $709,283 in the City of Toronto.

Delving into new listings and inventory, December’s numbers play a crucial role in setting the stage for the upcoming year. New listings saw a year-over-year decline of 6.61%, settling at just 3,886—compared to the 10-year average of 4,676 for the same month. Active listings reached 10,401, approximately 2,000 more than the typical figure. December’s sales-to-new-listings ratio surpassed all other months this year, absorbing a substantial portion of that inventory. Notably, over 25% of December’s new listings were “re-lists,” not truly new for potential buyers.

Looking forward to 2024, the central theme appears to be affordability. Major lenders project a progressive drop in rates, commencing in Q2 and possibly culminating in a 1.5% policy rate reduction by Q4—from 5% to 3.5%. The latest RBC report anticipates a modest improvement in affordability, predominantly driven by reduced borrowing costs. The initial quarter of 2024 may mirror the recent past until rates begin to decline, likely ushering in heightened activity and a marginal uptick in prices.

“Assuming borrowing costs trend lower this year, look for tighter market conditions to prompt renewed price growth in the months ahead,” said TRREB Chief Market Analyst Jason Mercer.

I anticipate a surge in market momentum following the initial benchmark rate reduction, setting the stage for a robust resale market in the latter half of 2024 both in an uptick in prices and sales volume.

The GTA real estate market will continue to grapple with persistent affordability challenges though, particularly in the freehold property segment. These constraints may temper the overall sales figures, underscoring the delicate balance between market dynamics and the economic realities that shape the real estate landscape. Keep a close eye on these developments as the market navigates the complexities of affordability in the second half of 2024.