January demonstrated a sudden shift in consumer optimism towards the real estate market in the Greater Toronto Area (GTA). The anticipation of a reprieve from the Bank of Canada’s interest rate hikes infused the air with renewed confidence. January unveiled a pivotal moment when the Bank chose to maintain its benchmark rate at 5%, validating the growing belief that relief was imminent. What sparked optimism further, was the Bank’s unprecedented revelation—it was not merely contemplating rate cuts, but actively strategizing for them. The question was no longer if but when these adjustments would materialize. Thus, the first month of 2024 unfolded against a backdrop of cautious optimism and eager anticipation, setting the stage for what promises to be an intriguing year ahead in the GTA’s real estate landscape.

“We had a positive start to 2024. The Bank of Canada expects the rate of inflation to recede as we move through the year. This would support lower interest rates which would bolster home buyers’ confidence to move back into the market. First-time buyers currently facing high average rents would benefit from lower mortgage rates, making the move to homeownership more affordable,” said TRREB President Jennifer Pearce.

This optimism was evident in January’s sales volume. According to the most recent report from the Toronto Regional Real Estate Board (TRREB), a total of 4,223 homes were sold in the GTA during the month—an impressive surge from December’s 3,444 transactions, marking a notable 22.6% increase. More strikingly, this is a substantial uptick compared to January 2023, with a remarkable 37% rise from the 3,083 sales recorded in the same period last year. This robust performance hints at a burgeoning momentum that bodes well for the months ahead.

TRREB notes this boom comes “as some homebuyers started to benefit from lower borrowing costs associated with fixed-rate mortgage products,”. Interest rates on five-year insured fixed interest rates began slipping below 5% at a number of lenders in Ontario towards the end of December thanks to the bond yield market having cooled in the preceding month.

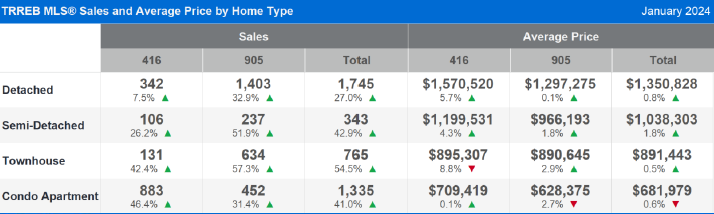

The increase in sales volume was seen across all housing types in the GTA, with townhomes leading the way at a staggering 54.5% year-over-year increase. They were closely followed by semi-detached homes up 42.9%, condo apartments at 41%, and detached homes at 27%.

The average price remained stable year-over-year with minimal fluctuation. In January of the previous year, the average sale price stood at $1,036,925, whereas this January it slightly decreased to $1,026,703, marking a marginal decline of 1%. This subtle shift was predominantly driven by diminishing condominium prices within the outlying suburban region, exerting an impact on the overall average sale price.

In the Greater Toronto Area (GTA), January witnessed increases in average prices across all housing types, except for condo apartments, which experienced a modest decline. Semi-detached homes led the upswing with a 1.8% rise, followed closely by detached homes with a 0.8% uptick, and townhouses with a 0.5% increase. Conversely, the average sale price of condo apartments dipped by 0.6%.

Within the City of Toronto, the housing market depicted a mixed landscape in January. Detached homes commanded an average price of $1,579,527, marking a robust 5.7% increase. Semi-detached properties followed suit, experiencing a notable 4.3% rise to reach an average price of $1,199,531. However, townhomes witnessed a decline of 8.8%, settling at an average price of $895,407, while condominium prices remained steady at $709,419.

As sales grew, so too did listings, with 8,312 new homes coming onto the market in January. However, on a seasonally adjusted basis, the number of new listings did not keep pace with the increase in sales, meaning market conditions tightened last month. In many neighbourhoods, multiple offer situations existed with properties sold in January. A trend we have not seen for some time.

“Once the Bank of Canada actually starts cutting its policy rate, likely in the second half of 2024, expect home sales to pick up even further. There will be more competition between buyers in 2024 as demand picks up and the supply of listings remains constrained. The end result will be upward pressure on selling prices over the next two years,” said TRREB Chief Market Analyst Jason Mercer.

It will be interesting to see the impact of legislative changes on Toronto’s luxury market. Effective 2024, purchasers of high-end homes exceeding $3 million face an additional graduated municipal land transfer tax. For instance, buying a $10 million property triggers a hefty land transfer tax totaling $652,950 ($236,475 provincial and $416,475 City of Toronto). Moreover, Toronto has upped its vacant home tax to 3% of the assessed property value. Coupled with a municipal property tax hike of over 10%, these measures collectively escalate residential market costs, counterintuitively rendering Toronto even less affordable.

TRREB released its 2024 Market Outlook and Year in Review last week and is predicting a notable rebound in the GTA’s housing market for 2024, foreseeing sales climbing to 77,000 by year-end, a 17% increase from 2023’s 66,000 transactions. New listings are expected to remain historically low at around 150,000, although this is an improvement from 2023. However, the market may not achieve balanced conditions as demand surges. Consequently, the average selling price is forecasted to rise by nearly 4% to $1.17M, the second highest on record but still below the peak in 2022.

TRREB underscores that the trajectory of mortgage rates will be pivotal in shaping the GTA’s housing landscape in the coming year. A recent Ipsos survey for TRREB indicates that almost half of respondents are unlikely to purchase a home in 2024 unless mortgage rates decrease significantly.

Read the full 2024 Market Outlook and Year in Review report. This sought-after resource provides industry insights and forecasts what’s in store for the GTA real estate market. Readers will discover new research on the social implications of unaffordability and what’s required to adequately prepare for a rising population.