The trend of robust activity with record home sales in the Greater Toronto Area (GTA) continued in February as buyers remained confident in their employment situations and took advantage of ultra-low borrowing costs. With multiple buyers continuing to compete for limited available listings, double-digit annual price growth was the norm throughout the GTA, with even stronger rates of growth in the suburbs surrounding the City of Toronto. The average price for all home types in the GTA officially eclipsing the $1 million mark for the first time in history.

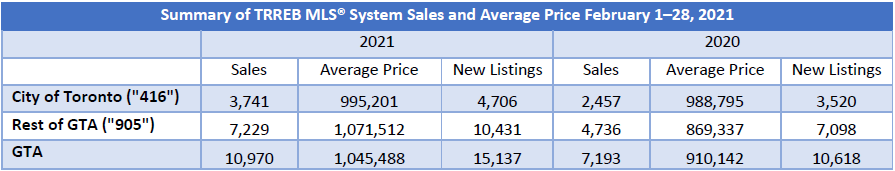

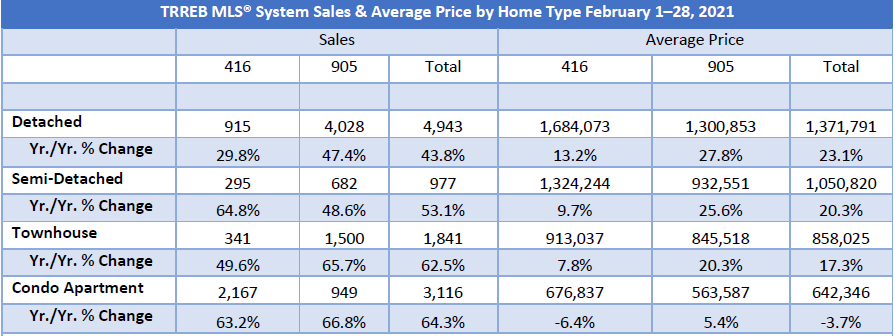

According to the Toronto Regional Real Estate Board (TRREB), there were 10,970 sales recorded in February — a 52.5 per cent increase compared to 7,193 sales reported in February 2020. Looking at all areas of the GTA combined, the condominium apartment segment led the way with a 64 per cent sales increase compared to last year, with similar rates of increase in the ‘416’ and ‘905’ area codes.

During this time, TRREB says there were 15,137 new listings in the GTA, with 10,431 in the ‘905’ area and 4,706 in the ‘416’.

“It’s clear that the historic demand for housing experienced in the second half of last year has carried forward into the first quarter of this year with some similar themes, including the continued popularity of suburban low-rise properties. It’s also evident that the supply of listings is not keeping up with demand, which could present an even larger problem once population growth picks up following widespread vaccinations later this year and into 2022,” said TRREB President Lisa Patel.

Thanks in part to historically low interest rates, bidding wars are driving up prices for housing stock both within the city confines and in the surrounding suburbs (and beyond), often to jaw-dropping amounts as former Toronto residents seek to satisfy a pandemic-inspired craving for more space and a reprieve from the city concrete.

The Bank of Canada Governor Tiff Macklem has already said he is unlikely to raise the overnight lending rate (the aforementioned 0.25 per cent) until 2023, when the post-pandemic economy is in better shape.

The MLS® Home Price Index Composite Benchmark was up by 14.8 per cent year-over-year in February 2021. Over the same period, the average selling price was up by 14.9 per cent to $1,045,488. While market conditions were tight throughout the GTA region in February, the detached, semi-detached and townhouse market segments in suburban areas were the drivers of average price growth, with annual rates of increase above 20 per cent in all three cases.

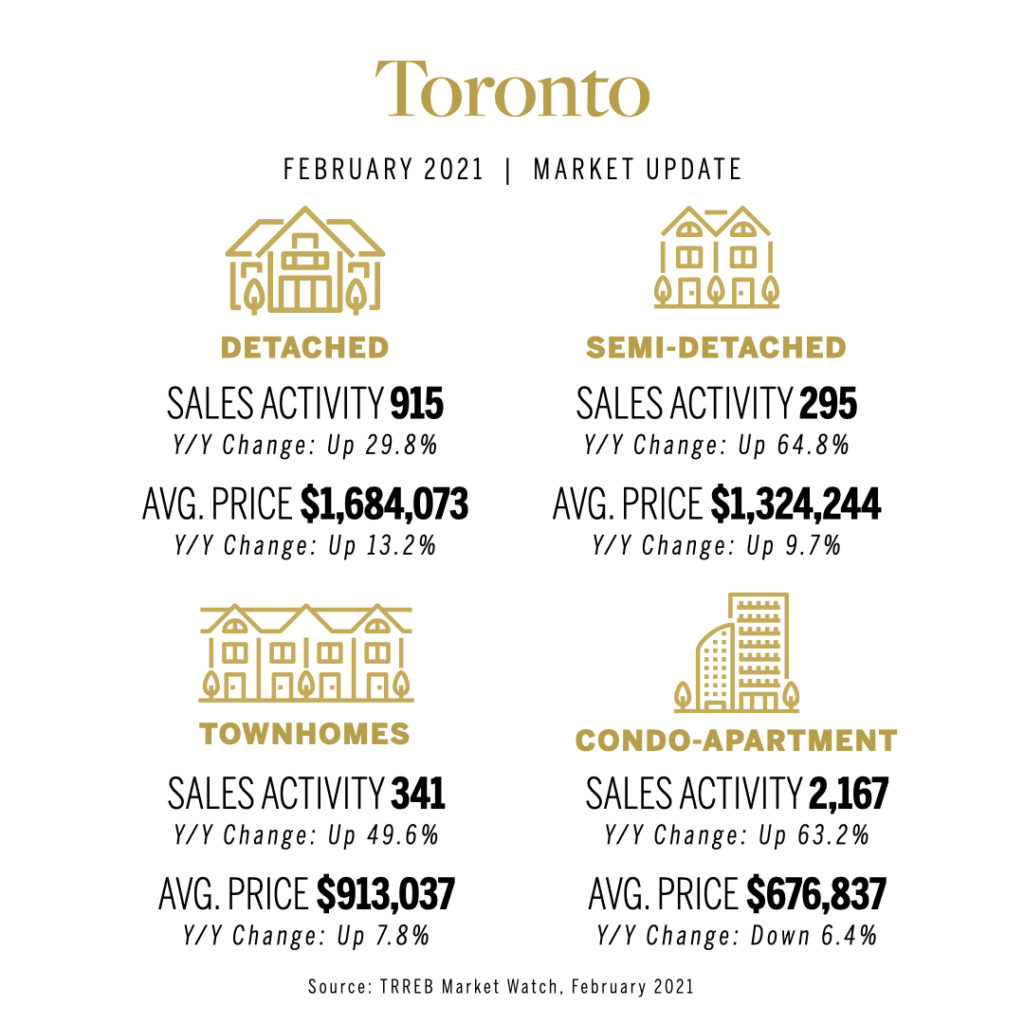

The average selling price of a detached house in the 905 areas increased to $1.3 million, a 27.8 per cent above February 2020. Here in the City of Toronto, detached houses sold for $1.7 million on average which is a 13.2 per cent annualized increase. The supply of detached and semi-detached properties in the city of Toronto is at an all-time low. In February, 915 detached properties were reported sold. By March, the inventory of detached properties was down to 938 homes which is one month of supply. The supply of semi-detached properties is also extremely tight. In February, 295 properties sold in this category. By the beginning of March, only 181 semi-detached properties were on the market, only .6 months of supply which is an unprecedented number.

“In the absence of a marked uptick in inventory, the current relationship between demand and supply supports continued double-digit average home price growth this year. In addition, if we continue to see growth in condo sales outstrip growth in new condo listings in Toronto, renewed price growth in this market segment is a distinct possibility in the second half of the year,” said TRREB Chief Market Analyst Jason Mercer.

“In the absence of a marked uptick in inventory, the current relationship between demand and supply supports continued double-digit average home price growth this year. In addition, if we continue to see growth in condo sales outstrip growth in new condo listings in Toronto, renewed price growth in this market segment is a distinct possibility in the second half of the year,” said TRREB Chief Market Analyst Jason Mercer.

The condo segment specifically saw strong sales volume a consecutive third month due to the still lower prices from last years downward turn, when buying preferences shifted from downtown condos to detached suburban homes. In the surrounding suburban areas condo prices did realize a bit of an uptick with an increase of 5.4 per cent year-over-year to an average of $563,587, while prices for apartment condos continued to fall in Toronto, declining 6.4 per cent compared to last February to an average price of $676,837.

“The pandemic has not stunted GTA residents’ appetite for owning a home. Once the economy opens further and immigration into the GTA resumes, there will be an even greater need for housing supply. Understandably, COVID-19 has been front and centre for policymakers. However, it will be important to build upon the proactive work already started by local and provincial governments to promote the development of a more diverse and affordable housing supply in our region,” said TRREB CEO John DiMichele.

TRREB’s February market report comes on the heels of the Canada Mortgage and Housing Corporation (CMHC) predicting that housing prices in big cities like Toronto will continue to climb through 2021. However, the national housing agency did warn the sustainability of this trend will depend on the uncertain course of the pandemic and said that there are still underlying issues that could impact the overall housing market in the months to come.

As we head into the spring months, we may see some heat come off the market as the seasonal trend is for more listings to come on the market during the traditional spring selling season. Overall, buyers in the GTA continue to show that they have a strong and unwavering interest in the market, which is likely to continue through the year making the supply issue even more critical. Affordability may start cooling demand in a few months from now or later this year, but right now the only thing holding back the market is lack of supply. There are a ton of buyers out there!