From Uncertainty to Opportunities with Signs of Shift Amid Surging Supply

The June housing numbers for Toronto and the Greater Toronto Area (GTA) paint a complex but revealing picture of a market in transition. While headline figures may appear soft at first glance, a deeper look suggests that momentum is quietly building, albeit under the weight of significant economic uncertainty and historically high inventory levels.

TRREB reported 6,243 home sales in June, essentially flat compared to May and just 2.4% below the same month last year. While that annual dip may seem discouraging, it represents the narrowest year-over-year gap in 2025 and marks the fifth consecutive month of rising or steady monthly sales. It was the first time since November 2024 that we’ve seen any positive annual increase in sales. These figures suggest a market slowly shaking off the paralysis brought on by cross-border tariff tensions, a sluggish domestic economy, and persistently high borrowing costs. Buyers who had been sidelined for months appear to be testing the waters again, encouraged by growing affordability and perhaps anticipating further interest rate relief.

“The GTA housing market continued to show signs of recovery in June. With more listings available, buyers are taking advantage of increased choice and negotiating discounts off asking prices. Combined with lower borrowing costs compared to a year ago, homeownership is becoming a more attainable goal for many households in 2025,” said Toronto Regional Real Estate (TRREB) President Elechia Barry-Sproule.

That said, supply continues to dominate the picture. Active listings soared to 31,603 by the end of June, up more than 30% year-over-year and reaching levels not seen in over three decades. Inventory growth has outpaced demand at every turn, and more than 30% of these listings are relisted properties that previously failed to sell. While new listings declined slightly from May (down 9.1%), they remained 10.4% higher than June 2024, suggesting that sellers, perhaps prompted by macroeconomic unease, remain eager to transact. This flood of inventory has given buyers the upper hand, leading to longer selling times, increased negotiating power, and downward pressure on prices.

Average sale prices reflected that reality. The GTA’s average price in June was $1,101,691, down 5.4% year-over-year and almost $20,000 lower than in May. The median price, often a better measure of broader affordability, came in at $950,000, down 4% annually. In the City of Toronto, the average price was slightly higher at $1,132,709, though that too was down 3.5% from last year and 2.0% from the previous month. The sales-to-new-listings ratio in the City came in at just 33%, confirming we are squarely in a buyer’s market.

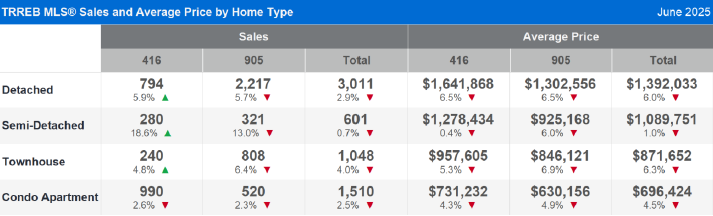

Yet within that broad framework, notable variations are emerging between geographies and housing types. In a striking reversal from the pandemic-era preference for suburban space, the City of Toronto saw growth in sales across all ground-oriented housing types, with detached, semi-detached, and townhouse transactions rising nearly 10%. In contrast, the 905 Region posted an 8% decline in the same categories. This suggests a slow return to Toronto’s urban core, particularly in the city’s eastern neighbourhoods, where semi-detached homes continue to attract strong interest and competitive bidding. In June, semi-detached properties in Toronto’s east end sold for an average of 108% of their asking price in just 14 days which was well ahead of the broader market average of 98% of list price and 42 days on market.

The condominium segment, which has been under pressure for some time, showed a softer landing in June. Condo apartment sales declined just 0.7% year-over-year across the GTA, while average prices dipped 4.3% to $696,424. In the City of Toronto, the average condo sold for $731,232, still down from last year but holding better than other housing types in the suburbs. While investor interest remains cautious, the slower pace of price erosion and stabilizing activity levels suggest the worst may be behind this sector.

“A firm trade deal with the United States accompanied by an end to cross-border sabre rattling would go a long way to alleviating a weakened economy and improving consumer confidence. On top of this, two additional interest rate cuts would make monthly mortgage payments more comfortable for average GTA households. This could strengthen the momentum experienced over the last few months and provide some support for selling prices,” said TRREB Chief Information Officer Jason Mercer.

Looking ahead, the direction of the market will hinge on key economic signals. While the Bank of Canada has already made seven modest rate cuts, the hoped-for resurgence in demand has been outweighed by a larger influx of listings. The central bank meets again in late July, and it is anticipated that rates will hold due to the strong jobs report and inflation holding steady. Time will tell. However, without progress on trade negotiations and concerns about employment levels or immigration policy resolved, downward pressure on prices could persist even with lower borrowing costs.

In sum, June may mark the early stages of a recalibrated market, one defined by steady sales, abundant inventory, and cautious but increasingly empowered buyers. For sellers, pricing strategically and preparing homes thoughtfully will be more critical than ever. For buyers, the market offers rare leverage and the luxury of time, something we haven’t seen in quite a while.