The Toronto real estate market in March 2025 presented a complex and highly segmented landscape, reflecting the push-pull dynamic between economic uncertainty and long-standing demand for housing in the Greater Toronto Area (GTA).

Overall, residential home sales remained sluggish, with only 5,011 transactions reported by TRREB (Toronto Regional Real Estate Board), a 23% decline from March 2024. However, this is a 24% improvement over February’s numbers, indicating a modest seasonal uptick. The market continues to be segmented, with clear distinctions between housing types and regional performance across the GTA.

“Homeownership has become more affordable over the past 12 months, and we expect further rate cuts this spring. Buyers will also benefit from increased choice, giving them greater negotiating power. Once consumers feel confident in the economy and their job security, home buying activity should improve,” said TRREB President Elechia Barry-Sproule.

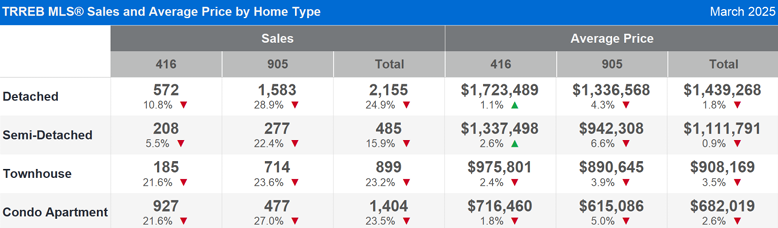

Despite broader market softness, detached and semi-detached homes in the City of Toronto demonstrated more strength. Detached properties sold for an average of $1,723,489, an increase of 1.1% from last March. Semi-detached homes performed even more robustly with an average sales price of $1,337,498, up 5% from February and 2.6% year-over-year. On average, all semi-detached properties sold for 107% of their asking price in only 15 days. In Toronto’s eastern districts, all semi-detached properties sold in just 13 days and, given the overall market, for an impressive 111% above their asking price. These numbers signal that well-located, low-rise housing remains highly desirable, particularly among move-up buyers and downsizers seeking urban convenience.

In contrast, the 905 Region saw a more significant slowdown. Detached, semi-detached, and townhouse sales declined by 25% year-over-year, while similar housing types in the City of Toronto declined by a more modest 12.6%. This regional disparity is also reflected in pricing. While ground-oriented homes in the 905 experienced a 5% price decrease, their counterparts in Toronto saw prices edge up by 1.3%.

Although the average selling price of all housing types remained objectively lofty, coming in at $1,093,254 at the end of March, it was down 2% month-over-month. Seasonally adjusted, the MLS® Home Price Index Composite benchmark was down 3.8% compared to March 2024 and flat compared to February 2025 on a seasonally adjusted basis.

The condominium apartment segment, which comprises a large portion of Toronto’s central housing stock, continued to decline in stark contrast to the performance of detached and semi-detached properties. In March, 1,404 condos sold, accounting for 30% of total transactions, but this represented a 23.5% drop compared to the same month last year.

Inventory is mounting, with 4,681 active condo listings, 35% of all listings in the region. The average sale price for all condominium apartments was $682,019, nearly 2 percent lower than last year. Condominium apartments sold for only 98 percent of their asking price, and on average, after 32 days on the market—33 percent longer than the overall market and almost 80 percent longer than detached and semi-detached properties. The average sale price for condominium apartments in the City of Toronto was slightly higher at $716,460.

Market hesitancy is not a reflection of diminished demand but rather affordability constraints and broader economic uncertainty due to the recent addition of U.S. tariffs. These policy changes are expected to have a greater impact in southern Ontario, potentially leading to job losses and further pressure on consumer confidence.

“Given the current trade uncertainty and the upcoming federal election, many households are likely taking a wait-and-see approach to home buying. If trade issues are solved or public policy choices help mitigate the impact of tariffs, home sales will likely increase. Home buyers need to feel their employment situation is solid before committing to monthly mortgage payments over the long term,” said TRREB’s Chief Information Officer Jason Mercer.

Despite the Bank of Canada lowering its overnight lending rate by 225 basis points since June 2024, lower borrowing costs have not yet led to a significant market rebound. A key reason is the counterbalancing effect of the tariffs, which have introduced fresh instability into an already cautious environment.

As a result, March saw not only fewer transactions but also a growing supply of homes, with new listings rising to 17,263 homes, a nearly 29% increase year-over-year. This has led to a more balanced or even buyer-friendly market in many areas. The latest TRREB forecast anticipates 76,000 total transactions in 2025, well below the 2021 peak of 120,000. Home price growth is expected to remain below the rate of inflation, further emphasizing the current shift toward a more stable, supply-rich environment.

For homeowners considering a move—particularly downsizers—the market presents a window of opportunity. While pricing remains relatively strong in prime Toronto neighbourhoods, the surge in listings and slower condo absorption rates mean that strategic timing and presentation are more critical than ever. For buyers, especially those leveraging equity from a sale, today’s conditions offer choice, negotiation leverage, and the potential for long-term value, particularly in the condo segment.

“While the policy debate heading into the federal election has rightly been focused on our cross-border trade relationship, it has also been important to see that the federal parties continue to view housing as a key priority based on the various election platforms. This is in line with recent polling suggesting access to housing options that are affordable remains top-of-mind for all Canadians. Building this housing will be a key economic driver moving forward,” said TRREB CEO John DiMichele.

As the year progresses, the market will remain sensitive to both economic signals and policy shifts. It is important to stay informed to be best positioned to succeed. Please feel free to reach out with questions at any time.