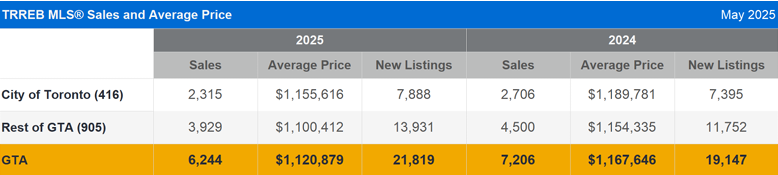

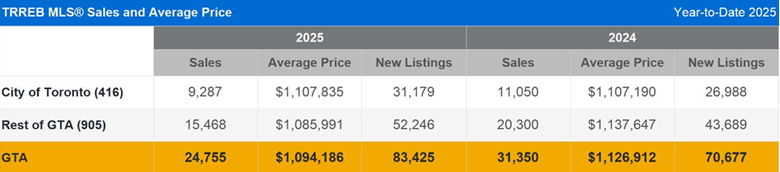

Confidence continues to lag in this spring market while inventory surges, creating opportunity for buyers. May’s real estate results for the Greater Toronto Area (GTA) reveal a market still defined by hesitancy, despite growing affordability and two straight months of sales growth. According to the latest data from the Toronto Regional Real Estate Board (TRREB), 6,244 homes traded hands last month, representing an 11.7% increase over April but still 13.3% below May 2024’s sales volume. While some seasonal momentum is evident, many buyers remain on the sidelines amid macroeconomic uncertainty and evolving global trade dynamics. Ignoring May of 2020, which was affected by the pandemic, last month’s sales are the lowest in any month of May in all time.

“Looking at the GTA as a whole, homebuyers have certainly benefited from greater choice and improved affordability this year. However, each neighbourhood and market segment have their own nuances,” said Toronto Regional Real Estate Board (TRREB) President Elechia Barry-Sproule.

The most striking development this spring has been the dramatic rise in inventory. Active listings soared to 30,964, up 41.5% year-over-year, reaching the highest level seen since TRREB began reporting monthly data in 2002. New listings also rose sharply, with 21,819 properties coming to market, marking a 14% annual increase. With a sales-to-new-listings ratio (SNLR) of just 29%, the GTA is firmly in buyer’s market territory. In comparison, May 2024’s SNLR stood at 38%.

For buyers, this shift means more choice, more negotiating power, and increasingly flexible conditions. For sellers, however, the heightened competition has placed downward pressure on prices and extended time on market. In fact, the average property took 39 days to sell in May, up from 28 days a year earlier, and sold for 99% of asking, compared to 102% in May 2024.

Surprisingly, with the rise in inventory and lagging sales, price trends show only modest declines. The average selling price across the GTA was $1,120,879, down 4% year-over-year but up 1.2% from April. Benchmark prices followed suit, with the MLS® Home Price Index showing a 4.5% annual decline. Within the City of Toronto, the average price was $1,155,616, representing a 3.2% annual drop and a more modest 0.9% monthly increase.

Despite recent rate cuts by the Bank of Canada, affordability improvements haven’t yet translated into a full market rebound. Many households remain cautious, influenced by trade instability and shifting government policy. According to TRREB, further reductions in borrowing costs and signs of economic stabilization may help re-engage buyers as the year progresses.

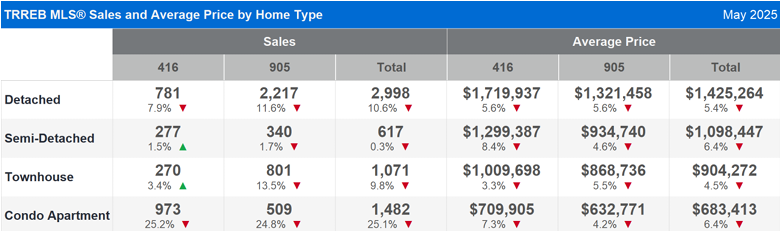

Breaking down the sales by home type, detached homes led the way in May with 2,998 sales, though this still represented a 10.6% decline from last year. Condo apartments saw the steepest drop at 25.1%, while townhouse and semi-detached home sales were down 9.8% and 0.3%, respectively.

“Homeownership costs are more affordable this year compared to last. Average selling prices are lower, and so too are borrowing costs. All else being equal, sales should be up relative to 2024. The issue is a lack of economic confidence. Once households are convinced that trade stability with the United States will be established and/or real options to mitigate our reliance on the United States exist, home sales will pick up. Further cuts in borrowing costs would also be welcome news to homebuyers,” said Jason Mercer, TRREB’s Chief Information Officer.

By property type, year-over-year average sale prices across the GTA for detached homes were $1,425,264, a decrease of 5.4%, semi-detached homes were $1,098,447, down 6.4%, townhomes were $904,272, down 4.5%, and condo apartments were $683, 413 down 6.4%.

In the City of Toronto, year-over-year average sale prices for detached homes were $1,719,937, down 5.6%, semi-detached homes were $1,299,287, down 8.4%, townhomes were $1,009,698, down 3.3%, and condo apartments were $709,905, down 7.3%.

These figures reflect improved affordability but also point to continued caution among buyers seeking long-term value and stability.

Looking ahead, despite seven rate cuts by the Bank of Canada over the past year, buyer confidence is still tentative, weighed down by uncertainty around global trade, U.S. policy, and domestic economic signals. For now, the market favours those with patience and perspective, especially buyers willing to act decisively in this high-inventory environment.

While year-over-year comparisons remain soft, back-to-back monthly gains in sales suggest that the market may be slowly regaining traction. The elevated inventory environment offers unique opportunities for well-positioned buyers to secure desirable properties with greater negotiating room.

For sellers, pricing strategy and presentation are more critical than ever. In today’s market, listings that showcase properties well and align with current buyer expectations are the ones that stand out.

As always, if you’re considering a move—or simply want to understand how these shifts may impact your property or investment—I’m here to provide thoughtful, tailored advice.