High borrowing costs and economic uncertainties persisted in November 2023, causing Toronto and Greater Toronto Area(GTA) homebuyers and sellers to take another step back from real estate. As the month unfolded, the tale of GTA’s real estate market told a story of dwindling sales on a year-over-year scale, a surge in listings from the previous year’s supply trough, and a market caught in the delicate balance of choice, reflected in relatively stagnant selling prices.

“Inflation and elevated borrowing costs have taken their toll on affordability. This has been no more apparent than in the interest rate-sensitive housing market. However, it does appear relief is on the horizon. Bond yields, which underpin fixed rate mortgages have been trending lower and an increasing number of forecasters are anticipating Bank of Canada rate cuts in the first half of 2024. Lower rates will help alleviate affordability issues for existing homeowners and those looking to enter the market,” said Toronto Regional Real Estate Board (TRREB) President Paul Baron.

A total of 4,236 home sales were reported in the GTA last month, which not only marked an 8.8% drop from October’s numbers, but a 6% decline compared to November 2022. When adjusted for seasonality, as activity tends to drop off in the winter, sales numbers saw a slight improvement from October, TRREB said.

The sales numbers for last month were the lowest on record for any November since November 2008 and at that time the population of the GTA was 20% less than it is today. This also marks the third consecutive month where the number of homes sold was less than 5000.

As sales waned, the price landscape followed suit, with the average GTA home witnessing a 3.9% month-over-month descent to a new average of $1,082,179. However, on a year-over-year basis, GTA home prices have remained strong and are practically unchanged, up less than 0.3% compared to last year.

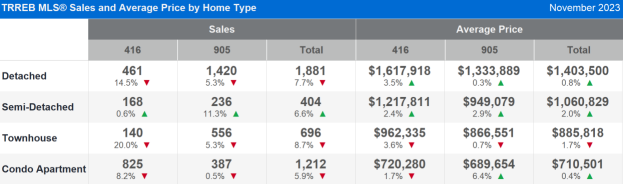

The City of Toronto is going through some choppy waters though as home prices and sales slow dramatically. The City of Toronto had an average selling price of $1,051,180, a significant 7% drop compared to last month. Year-over-year, City of Toronto home prices are also essentially unchanged. Toronto home sales, which numbered 1,607 in November 2023, are down by 12.5% monthly and down 11% year-over-year. The biggest change was seen amongst Toronto’s detached homes, where sales fell 21.3% and a notable drop in the average price to $1,617,918 from $1,718,440 month-over-month.

Looking at the GTA, prices remain steady on a monthly basis, despite some larger movements year-over-year. The average price of a detached home in the GTA was $1,403,500 in November 2023, a 1% increase year-over-year and down 3% month-over-month. Semi-detached home prices increased 2% year-over-year to an average price of $1,060,829. That’s also down 4% from last month. Freehold townhouses are seeing prices down about 5.5% monthly at $984,357, down 1% year-over-year.

While condo sales in the suburbs edged down 0.5% in November year-over-year, the price jumped 6.4% to $689,654. In Toronto, the average price for a condo dropped 1.7%, while the number of sales also decreased by 8.2%. This is not surprising as this is generally the least expensive housing type and the cohort of people looking to buy are primarily first-time buyers who are most vulnerable to the affordability constraints.

“Home prices have adjusted from their peak in response to higher borrowing costs. This has provided some relief for buyers, from an affordability perspective. As mortgage rates trend lower next year and the population continues to grow at a record pace, expect demand to increase relative to supply. This will eventually lead to renewed growth in home prices,” said TRREB Chief Market Analyst Jason Mercer.

For those ready to embark on the homeownership journey, the landscape offered more choices than the previous year. Inventory levels experienced a robust boost in November, with 10,545 new listings coming on the market, bringing the number of active listings up to 16,759 — a 40.7% increase from November 2022.

Looking ahead there is optimism as mortgage rates look poised to descend in the coming year, coupled with a record-paced population growth, setting the stage for a potential surge in demand relative to supply and a subsequent rebound in home prices.

TRREB’s Chief Executive Officer John DiMichele, echoing sentiments of resilience and foresight, emphasized the enduring nature of homes as havens. Anticipating sustained growth in demand for both rental and ownership, DiMichele highlighted recent policy decisions aiming to bolster affordability, such as enabling existing insured mortgage holders to switch lenders without the stress test. He further underscored the need for a unified approach to uninsured mortgages and stressed the imperative for additional policy measures to spur increased housing supply.

In the intricate tapestry of GTA’s real estate market, the narrative of November 2023 unfolded with challenges, adjustments, and a palpable sense of anticipation for a market on the brink of change. The next few months may provide some great buying opportunities before the forecast of an interest rate decrease as early as March 2024.