The Greater Toronto Area (GTA) residential real estate market appears to be at a standstill with both sellers and buyers waiting on the sidelines. The market activity in November continued to be influenced by the impact of higher borrowing costs on affordability.

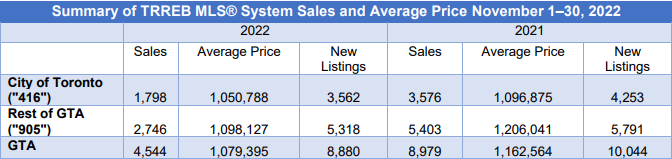

Sales were down markedly compared to the same period last year, following the trend that unfolded since the commencement of interest rate hikes in the spring. The Toronto Regional Real Estate Board (TRREB) reported a total of 4,544 homes traded hands last month, down 49% on an annual basis and 8.4% from October. This is the lowest number of monthly sales recorded in 2022 and it has been almost 15 years since the market has seen numbers as low as those produced in November.

Although the average sale price has declined by almost 20 percent since the peak in February 2022, it appears to have stabilized. In November the average sale price for all residential properties sold in the GTA, including condominium apartments came in at $1,079,395, a 7.2% decline year-over-year and remained roughly flat on a monthly basis, down just 0.9%. Since the late summer, the average sale price has been hovering around the $1.1M price point.

In addition to the softening of average home prices, the MLS Home Price Index Composite Benchmark – the index, which excludes sales of extremely expensive homes and is the industry’s preferred measure of home prices, is down 5.5% compared with November of last year.

The benchmark was pulled lower due to price declines that were concentrated in the most expensive market segments, such as detached and semi-detached houses, says Jason Mercer, TRREB’s Chief Market Analyst.

“Selling prices declined from the early year peak as market conditions became more balanced and homebuyers have sought to mitigate the impact of higher borrowing costs,” he says. “With that being said, the marked downward price trend experienced in the spring has come to an end. Selling prices have flatlined alongside average monthly mortgage payments since the summer.”

Average sales prices outside the city limits have declined more rapidly than in the City of Toronto since the pandemic market peak in February and March of this year. The exodus from the city that drove prices up in the communities surrounding the city has greatly dissipated and with that average prices have declined. The average price of all property types in the 905 area was down 8.9% year-over-year at an average of $1,098,127, compared to an annual decrease of 4.2% in Toronto at $1,050,788.

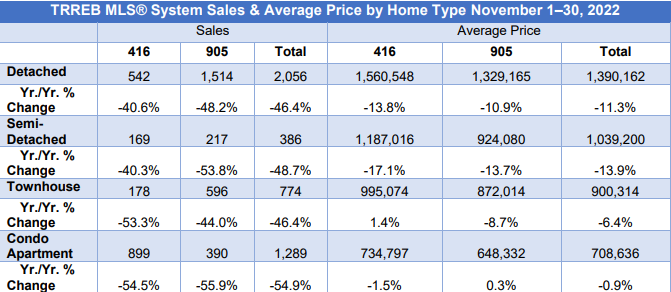

Semi-detached home prices absorbed the largest year-over-year decline, down 13.9% to an average of $1,039,200 for the whole GTA. In the City of Toronto, semi-detached homes were down 17.1% to an average of $1.187M. That was followed closely by the detached segment, down 11.3% in the GTA, to an average of $1.39M. In the City of Toronto, the average price of a detached home averaged $1.56M a drop of 13.8% year-over-year.

The trend continues with the smallest price declines for the most affordable market entry points, particularly under the $ 1M mark. Townhouse prices dipped by 6.4% to an average of $900,314, while condo prices remained flat with a 0.9% decline and an average price of $708,636. In the City of Toronto, the average condo price was $734,797 a drop of 1.5%.

One of the factors keeping average sale prices from falling below $1M has been the lack of supply. In November only 8,880 new properties came on the market compared to 10,044 last year, a decline of almost 12%. Lack of demand was almost identical both in and outside of the City of Toronto; a total of 1,798 sales occurred within the “416” region, while 2,746 sold in the 905, both reflecting losses of 49.7% and 49.1%, respectively. In this evolving market, sellers are not under any pressure to get their properties on the market, and it appears they are prepared to wait and see if the market conditions improve.

Buyers are still in the market, even with the shifting market landscape. In addition to the lack of supply, they are constrained by the lack of affordability caused by rapidly rising mortgage interest rates and a wait-and-see attitude. It appears buyers are trying to determine if mortgage financing costs have stabilized and what their future direction might be, along with considering if home prices have reached the lowest point of their decline.

“Increased borrowing costs represent a short-term shock to the housing market. Over the medium- to long-term, the demand for ownership housing will pick up strongly. This is because a huge share of record immigration will be pointed at the GTA and the Greater Golden Horseshoe (GGH) in the coming years, and all of these people will require a place to live, with the majority looking to buy. The long-term problem for policymakers will not be inflation and borrowing costs, but rather ensuring we have enough housing to accommodate population growth,” said TRREB President Kevin Crigger.

Earlier this month the Bank of Canada once again increased its benchmark rate to 4.25%. In February it was 0.25 percent – this is an unprecedented increase of 1,600% in only 9 months. Although this last increase was painful there does seem to be some positive light as the Bank of Canada indicated that further increases may be at an end. In the past, all rate hikes were accompanied by announcements stating that further increases could be expected, and they happened on schedule. This time the Bank indicated it will assess the inflation landscape in January and depending on its findings, only then decide if further increases are necessary. If the Bank concludes no further increases are necessary at its next meeting, this will be the signal that the real estate marketplace we have been experiencing is coming to an end. The resale market will begin to adjust to the new normal resulting in greater buyer participation and increased sales. Unfortunately, it is too early to make any determinations.