September brought a welcome shift in Toronto’s housing market, as momentum began to return following the Bank of Canada’s first interest rate cut since early 2025. Buyers re-entered the market with renewed confidence, encouraged by more affordable monthly mortgage payments and an abundance of choice. The result was stronger sales activity and early signs of stabilization after a challenging year.

“The Bank of Canada’s September interest rate cut was welcome news for homebuyers. With lower borrowing costs, more households are now able to afford monthly mortgage payments on a home that meets their needs. Increased home purchases will also stimulate the economy through housing-related spin-off spending helping to offset the impact of ongoing trade challenges,” said Toronto Regional Real Estate Board (TRREB) President Elechia Barry-Sproule.

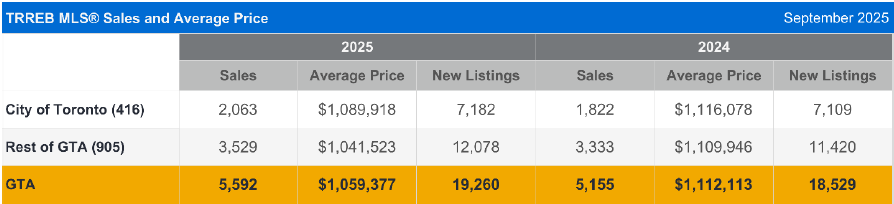

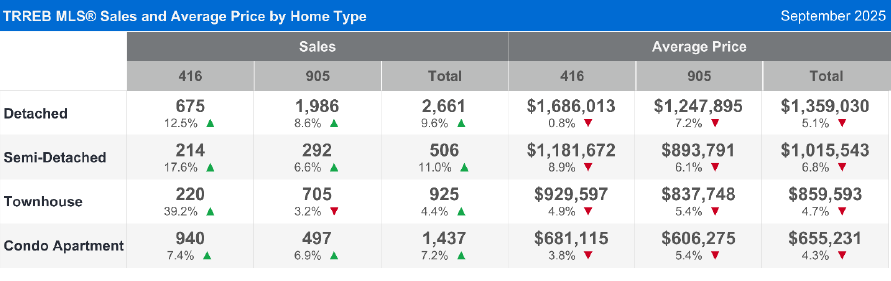

Across the Greater Toronto Area (GTA), the Toronto Residential Real Estate Board (TRREB) reported 5,592 sales, an 8.5% increase compared to last September, and roughly 7% higher than August’s totals. The City of Toronto itself saw 2,063 sales, up 14% year-over-year, slightly outperforming the broader region. Detached, semi-detached, and condominium sales all posted gains, with townhouses leading the charge, particularly in Toronto’s central districts, where sales surged by nearly 40%.

While this upswing is encouraging, it’s important to recognize the underlying dynamics. The uptick in activity was less about a sudden surge in demand and more about a market adjusting to meet buyers on their terms. The elevated inventory levels of nearly 30,000 active listings by month’s end gave purchasers the time, leverage, and confidence to negotiate. In many cases, properties that had been previously listed and failed to sell were reintroduced to the market at reduced prices, creating a more compelling landscape for motivated buyers.

“While home sales have improved over the past year, they still remain below normal levels relative to the number of households in the GTA. Two more 25-basis-point interest rate cuts by the Bank of Canada would see monthly mortgage payments move more in line with homebuyers’ average incomes, further spurring home sales and related economic activity,” said TRREB Chief Information Officer Jason Mercer.

Average and benchmark prices continued their gradual decline on an annual basis, though the pace of correction is moderating. The GTA’s average selling price came in at $1,059,377, down roughly 5% year-over-year. The MLS® Home Price Index (HPI) Composite Benchmark fell 5.5% annually, yet the monthly data tells a different story: the average price edged up 0.2% month-over-month, while the median price rose 2.5%, hinting that values may be approaching a floor.

In the City of Toronto, the average price was slightly higher at $1,089,918, representing a more modest 2.1% annual decline but a notable 9.9% increase from August. A strong signal that the downtown market may be stabilizing sooner than the surrounding regions. Detached homes in the GTA averaged $1,359,030, semis $1,015,543, and condos $655,231, each down between 4% and 7% from last year.

Even amid these price declines, select pockets of demand remain resilient. Semi-detached homes in neighbourhoods like Riverdale, Leslieville, and The Beaches continued to attract fierce competition, often selling above asking, with an average of just 11 days on market.

New listings totaled 19,260 in September, up approximately 4% from a year earlier, while active listings rose 15% annually but declined slightly from August, suggesting supply may be leveling off. The sales-to-new-listings ratio (SNLR) stood at 29%, confirming that the GTA remains a buyer’s market, but one showing early signs of tightening.

With ample choice and softened prices, buyers are firmly in the driver’s seat. On average, homes sold for 98% of the asking price after 33 to 51 days on the market, depending on the property type. Sellers, on the other hand, are learning to navigate this new reality. Pricing strategically, offering incentives, and preparing properties thoughtfully to stand out in a competitive landscape is key.

“Housing industry stakeholders have, for the most part, worked independently to reach our parallel goals, but momentum appears stalled. At a time when we are facing a collapse of new construction sales and starts, it’s time for us to come together as a unified voice, align our efforts, and collectively work to break down the remaining barriers that impede progress in housing development. TRREB will approach our partners in a renewed effort to reignite momentum with industry leaders, policymakers, and stakeholders in the Greater Golden Horseshoe,” said TRREB CEO John DiMichele.

Looking ahead, while challenges remain from global trade uncertainty to evolving immigration policy, the combination of lower borrowing costs and more attainable prices has begun to reawaken buyer interest. The data suggests that September may mark a turning point, a market still favouring buyers, but with a firmer footing beneath it.

As we move into the final quarter of 2025, the expectation is for a more balanced and stable market, with continued improvement in sales and a gradual firming of prices heading into 2026. For those positioned to act, this fall may offer one of the most advantageous buying environments Toronto has seen in years. Opportunities are out there and it is a time to buy smart, not fast!